In November 2021, KemPharm, Inc. reported financial results for the third quarter ending September 30, 2021. Key takeaways from the company’s earnings release and conference call were that the company continues to generate meaningful service revenues, operating burn remains low, royalties from Corium on sales of AZSTARYS® should commence in earnest next year, and the cash position remains strong at $131.5 million. Importantly, KemPharm is now focused on executing its strategic growth plans, which include expanding the company’s pipeline and commercialization capabilities.

In connection with focusing on executing its strategic growth initiative, KemPharm announced that Richard W. Pascoe has been named Executive Chairman. Pascoe previously held the role of Lead Independent Director for the company and now brings his decades of experience in the biopharma industry in-house to KemPharm. Pascoe held the role of CEO in his last three positions and has successfully raised over $300 million in equity capital, taking private companies public, closed more than $2 billion of value in business development transactions, and led commercial launches of prescription drugs in the U.S. across multiple therapeutic categories.

Importantly, Mr. Pascoe has significant experience in the CNS area, which includes roles as SVP of Neuroscience for King Pharmaceuticals, later acquired by Pfizer, CEO of Somaxon Pharmaceuticals which focused on sleep disorders, later acquired by Pernix in 2013, and he currently serves on the Board of Seelos Therapeutics which is focused on neuro-psychiatric disorders. This experience will be invaluable as KemPharm conducts a review of its strategic options for growth.

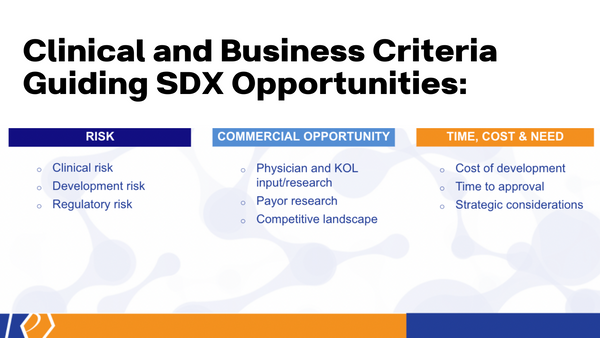

Central to the company’s future growth plans are identifying the next set of clinical studies and indications for serdexmethylphenidate (SDX). From a strategic standpoint, the recent DEA classifying SDX as a Schedule IV controlled substance was a big win because it substantially increases the potential value and product differentiation in CNS indications outside of ADHD. This is the second-lowest scheduling for approved medications and below the current Schedule II status for other CNS stimulants, which is a differentiator compared to other products based on methylphenidate and amphetamine. The company initiated a safety, tolerability, and pharmacokinetic and pharmacodynamic study with SDX earlier in the year, and data is expected in December 2021. KemPharm plans to analyze this data, which include higher doses of single-agent SDX than those approved for AZSTARYS®, and provide guidance during the first quarter of 2022 on the best path forward for future development of SDX-based product candidates. The PK/PD data will help the company narrow down therapeutic indications where SDX may hold value, but the overall strategic review will include a comprehensive evaluation of regulatory pathway, clinical development costs, timelines, and execution risk, and commercial implications such as peak sales potential, payor access, and the competitive landscape.

Beyond a strategic review and future development decisions with SDX, KemPharm is also exploring the biopharma landscape for opportunities to acquire or in-license novel product pipeline candidates. KemPharm’s management team will deploy a similar comprehensive strategy review for potential product candidates to expand the company’s development pipeline. The focus will be on understanding cost, timing, the commercial and competitive landscape. KemPharm will also look for synergies that can be leveraged using the company’s significant discovery and clinical and regulatory expertise. The ultimate goal is to create shareholder value by building a robust pipeline of novel products in the CNS space which can generate significant value itself, as well as potentially attracting a larger organization seeking to enhance its preclinical discovery, clinical development, and commercial sales prospects.

From a financial standpoint, KemPharm has never been in better shape. The FDA approval and DEA scheduling provided $20 million in cash regulatory milestones to KemPharm from Corium during 2021. With the launch now underway, KemPharm is now positioned to receive additional commercial milestones in the future of up to $550 million, on top of royalty payments on net sales of AZSTARYS® ranging up to a percentage in the mid-twenties. These milestones and royalty payments are expected to commence in a meaningful way in 2022 and are anticipated to last for at least the next 16 years to the final patent expiration in 2037. Furthermore, because of the final DEA scheduling decision and its differentiated product label, KemPharm believes that peak sales of AZSTARYS® could be higher than originally forecasted.

The future looks bright for KemPharm. AZSTARYS® is in the hands of a capable commercial partner and management sees upside to the current sales models proposed by financial analysis. The company’s internal and external pipeline expansion efforts are underway. The stock was added to the Russell 2000 and 3000 indexes, and most recently was uplisted to The Nasdaq Global Select Market. Moreover, the company is in a solid financial position with a strong balance sheet, no debt, and a low burn rate. All of these factors provide the potential for KemPharm to transition from a small developer of drugs for out-licensing to larger pharmaceutical companies into a profitable, fully integrated biopharmaceutical company with retained asset value leading to increased market value.

KemPharm is a specialty pharmaceutical company focused on the discovery and development of proprietary prodrugs to treat serious medical conditions through its proprietary LAT® (Ligand Activated Therapy) technology. KemPharm utilizes its proprietary LAT® technology to generate improved prodrug versions of FDA-approved drugs as well as to generate prodrug versions of existing compounds that may have applications for new disease indications. KemPharm’s prodrug product candidate pipeline is focused on the high need areas of attention deficit hyperactivity disorder, or ADHD, stimulant use disorder (SUD), and CNS rare diseases, including idiopathic hypersomnia (IH). In addition, KemPharm has received FDA approval for AZSTARYS®, a new once-daily treatment for ADHD in patients age six years and older, and for APADAZ®, an immediate-release combination product containing benzhydrocodone, a prodrug of hydrocodone, and acetaminophen. For more information on KemPharm and its pipeline of prodrug product candidates visit www.kempharm.com or connect with us on Twitter, LinkedIn, Facebook and YouTube.

This press release may contain forward-looking statements made in reliance upon the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include all statements that do not relate solely to historical or current facts and can be identified by the use of words such as “may,” “will,” “expect,” “project,” “estimate,” “anticipate,” “plan,” “believe,” “potential,” “should,” “continue” or the negative versions of those words or other comparable words. Forward-looking statements are not guarantees of future actions or performance. These forward-looking statements, including the continued commercialization of AZSTARYS® and the further development of KemPharm’s pipeline of product candidates, are based on information currently available to KemPharm and its current plans or expectations and are subject to a number of uncertainties and risks that could significantly affect current plans. Risks concerning KemPharm’s business are described in detail in KemPharm’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2021, and KemPharm’s other filings with the Securities and Exchange Commission. KemPharm is under no obligation to, and expressly disclaims any such obligation to, update or alter its forward-looking statements, whether as a result of new information, future events, or otherwise.