Typically, I would start off any call reminding all of our listeners of the great things we have done over the past few months. But today, I'm not going to rehash the past as today's call is squarely focused on the future. Some of these changes and insights are subtle shifts from where we've been historically, while others move us forward in new directions, and, if all goes as hoped and planned, towards bigger opportunities.

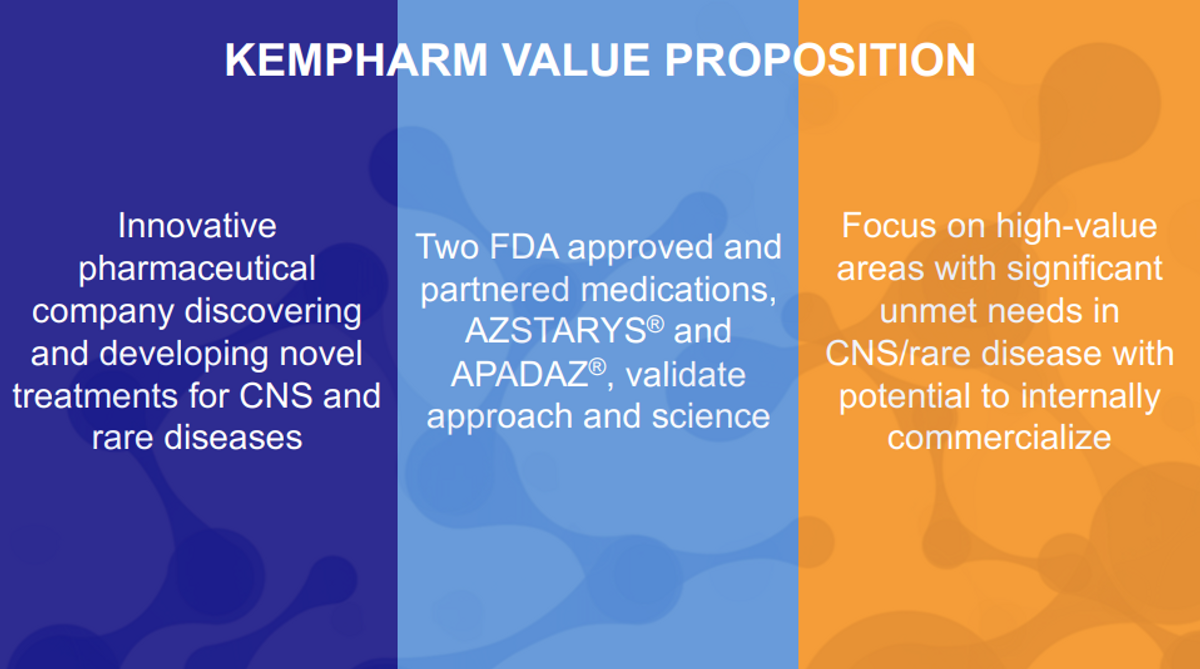

For much of KemPharm's existence, we have solely focused on the discovery and development of prodrugs. While prodrugs are a part of our future, especially serdexmethylphenidate or SDX as it's known, we will look beyond them to new opportunities in areas that represent potentially higher value in the marketplace.

Additionally, in the past, we focused on in-licensing of our development products to other commercial organizations. While we've been successful in that approach. We now intend to look for programs we can commercialize in a measured and capital efficient manner while retaining the vast portion of the commercial upside. CNS niche markets, CNS rare diseases, rare diseases themselves allow us that possibility.

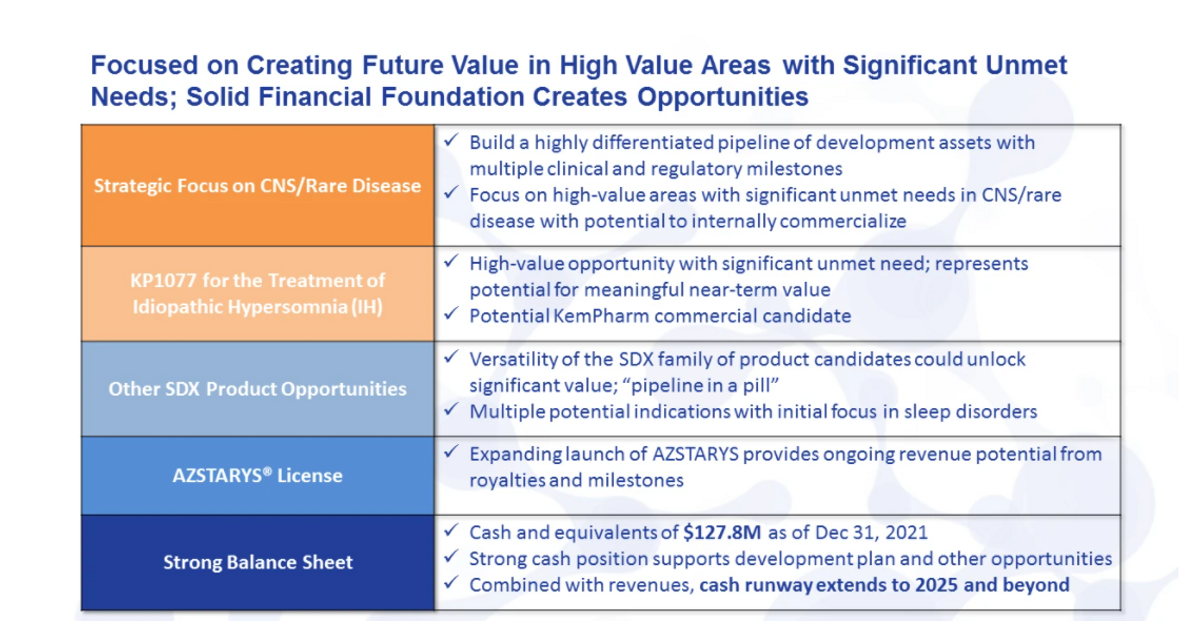

To help illustrate the strategy and focus, I believe this table provides us a great outline. Fundamentally, this approach is built on a solid foundation of cash and potential AZSTARYS® revenue. With those as our support and backing, we believe we can execute on our development plan without the need for further funding. On top of that solid foundation, working from what we already have in SDX makes a lot of sense as long as it would fit the value proposition we are trying to build towards.

Fortunately, it does just that. Given these properties, SDX is suited for a number of potential indications. If we think about the market value and the ability to commercialize, rare sleep disorders is a highly valuable space with high unmet needs, multiple potential indications and strategic benefits. Certainly, this space has been dominated by Jazz Pharmaceuticals, but recent players like Harmony Biosciences have proven that differentiated products can compete and do well.

When we focus a little more on SDX, we evaluated a host of criteria for our lead development program, including the market, scientific risk, timing and cost. And we identified that idiopathic hypersomnia was the ideal first indication for SDX. I will outline in detail how that is, and what we believe that potential value could be in just a moment.

With the solid foundation in our first development candidate in hand, the strategic focus of KemPharm will be continuing on to develop further differentiated assets in the niche CNS/rare disease space, where we have the opportunity and possibility to commercialize those assets, and retain most, if not all, the value from those development programs.

This pipeline of development products will be generated from both internal and external sources. So in addition to SDX and our other possible product opportunities, we have actively engaged in identifying new novel clinical stage candidates that can add to our pipeline and potential near-term milestones.

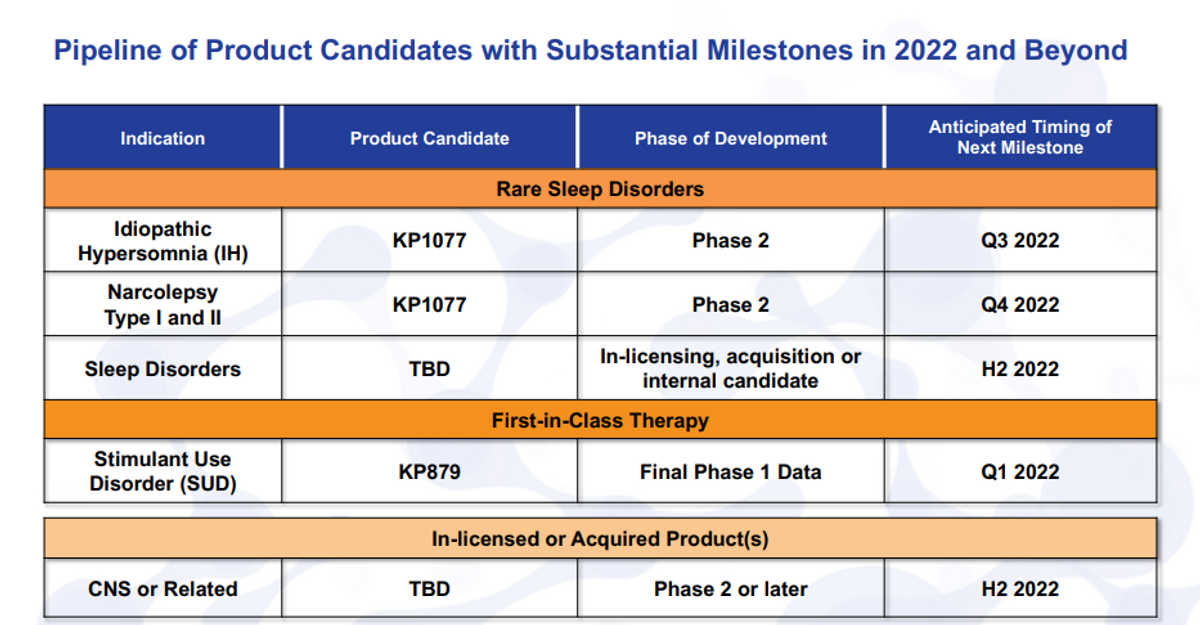

So now, turning to the pipeline, we can see from the pipeline itself. Actually, I have to turn to the pipeline too. As the pipeline shows here, KP1077 really is a great example of exactly what we're looking for when we assess any of the assets, internal or external. We have near-term clinical catalyst - it's a Phase 2 asset or later, where, you know, again, rare or niche indications, idiopathic hypersomnia (IH) is a rare orphan disease, so is narcolepsy.

And then on top of that, you know, you have to measure that with risk and reward. Certainly, it's a much lower risk because it's SDX, it's already 70 percent of the component in an approved product in AZSTARYS. High reward, you know, this market is untapped and I'll go through what that potential could be. And then, of course, a reasonable cost for the development - if it takes more than our available resources, it probably does not make as much sense.

So with that, you know, KP1077 in idiopathic hypersomnia is our most advanced candidate. We are looking to add to that indication, narcolepsy makes perfect sense to add on a large market opportunity. Though it is more crowded, as far as competitive landscape, it could be a great bolt on to idiopathic hypersomnia claim. Additionally, we have other thoughts on sleep disorders, both internally, and have identified a few external candidates.

And it's still in our pipeline and still under development would be KP879 for stimulant use disorder. We will receive our final Phase 1 data here shortly, and then I will speak more about this particular program a little bit later in the discussion.

I'll take a moment here just to add a little bit of something about the ROFN and ROFR, so the right of first negotiation and right of first refusal for these assets. So there have been a number of questions I can quickly address. So for any one of these clinical candidates related to SDX which would, you know, basically everything here, except for the in-licensed or acquired product candidates, potential candidates, GPC Corium-Commave have a right of first negotiation after the first human proof of concept study, so this would be the first study conducted after IND is opened for each product candidate.

So as you're aware, there's already an IND opened for KP879. So once the final data package is available, we will provide that to GPC. They'll have the ability to execute on their right of first negotiation. We're under no obligation to accept economic terms negotiated during that time. Certainly, we can as well if they're beneficial. But at the same point, then that converts to a ROFR on any valid third party offer. So for us on any of these candidates, we control exactly what we want to do with that and just have to offer it up, if somebody else comes to make an offer to acquire or license that product.

So I just wanted to clarify that, that would also, you know, come into play each time we add an indication or new product - so KP1077 or idiopathic hypersomnia, same with KP1077 for narcolepsy, and anything to do with SDX.

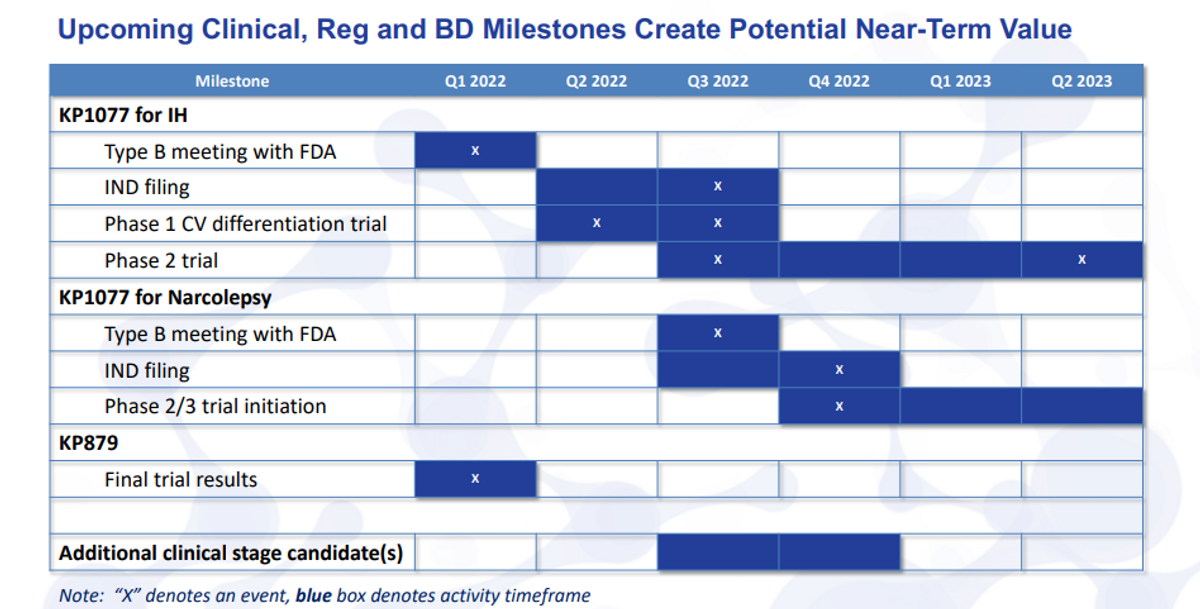

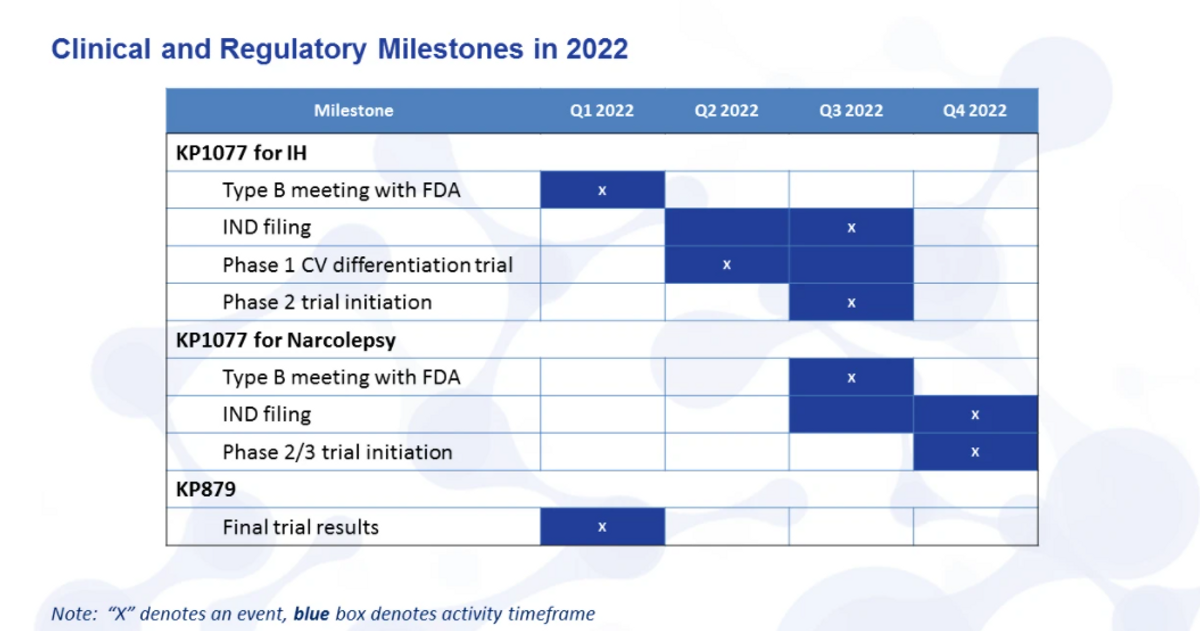

Moving on to the next slide, I just want to highlight for everyone here the upcoming clinical, regulatory and business development milestones. So we see from the pipeline, we're trying to build each one of these product candidates.

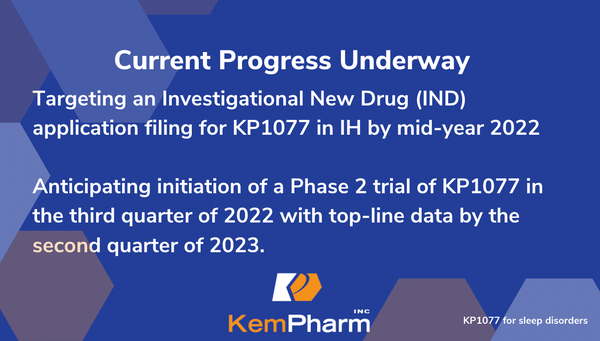

This quarter, we have two milestones that we hope to meet. One type B meeting with the FDA for KP1077, as well as the final trial results for KP879. IND filing is planned for mid-year. So we have it here as late as third quarter, but, you know, it really will be around that mid-year time frame. Once the IND is opened, and, of course, we can start the Phase 2 trial.

We do have a planned study that we can actually conduct before we get the IND opening study done, as SDX is being studied under the KP879 IND. It's a Phase 1 cardiovascular differentiation trial to show that the safety, heart rate and blood pressure measures are actually different than other immediate release or extended release stimulants.

We already know that we've seen safety benefits for abuse and other measures with the SDX given its scheduling status. So we're very excited about the possibility to show this trial safety difference. The Phase 2 trial will start in third quarter, and it should read out topline data in the first half, really the second quarter of 2023.

When we start to move into narcolepsy, will just be kind of, as you can see, staggered there from the KP1077 for IH with the type B meeting. After you get the IND filed and the study underway, as well as the trial initiation would be, you know, several months lagging from that.

And we do hope, sometime in the second half of this year, to have additional clinical stage candidates. More than likely that could come from external sources - or in-licensing, or acquisition, but it also may come from internal sources as we start to identify new candidates in some of these rare diseases and sleep disorders.

So moving on to the next slide, here, just briefly on the transition slide seven. As I mentioned before, we really see KP1077 as a great example, perfect example of a clinical candidate that we intend to develop and potentially commercialize. So a lot of this will be, of course, our first candidate and what we're focused on initially. But it also gives you a sense for what we would be looking for, whether it's an internal or external candidate that we move forward with.

So specifically looking at IH, this is something we haven't spent a lot of time informing you of the disease state and the population here. This is a rare disease. There's roughly 37,000 individuals diagnosed with IH that are actively seeking treatment.

The total population has been estimated much larger, but it's not really well known. It's more of a diagnosis by elimination of other issues. So if you don't have narcolepsy, if you don't have sleep apnea and so forth, you're kind of left with this IH sort of designation. The symptoms here are highly debilitating.

Many of the KOLs we've spoken to have said to us that IH can really be worse than narcolepsy, and we all know that that's a severe disease, and it causes a lot of issues for those poor individuals that have that problem.

Chronic daytime sleepiness - this isn't just a normal sleepiness. This literally is... You’re fearful to drive a car because you're just not aware enough to do so. Even simple tasks like walking, walking in your own home, moving around, you know, these things are chronically a problem for everybody with IH. Long and unrefreshing naps, extreme difficulty waking.

So, you know, I think all of us can know that it can be difficult at times to wake up in the morning. These individuals have multiple alarms. Usually a caregiver or somebody else in the household is also told: "I have to get up by this time". And you know, still, it's just completely difficult for these individuals to get up and wake up. Severe brain fog - this is probably one thing that we heard time and time again - "that's not treated by the current treatments at all off-label or on-label".

Just the inability to have any sort of level of executive function. And then about 25 percent of patients are what known as long sleepers, so excessively long sleep times greater than 10 hours, some 12-14 hours, and this is day in, day out. So, you know, literally their life is some form of disability - can't hold jobs, difficulties in social situations and family as well.

Many of the KOLs that we also spoke to have identified that depression is a common comorbidity. Obviously, if you have these conditions, you know, that could be problematic and could lead to a depression. And that the current treatments are really inadequate - many patients say "it's just poor medication effectiveness". It helps, but it doesn't help enough, and it certainly doesn't take away, you know, the vast majority of the symptoms they experience with IH.

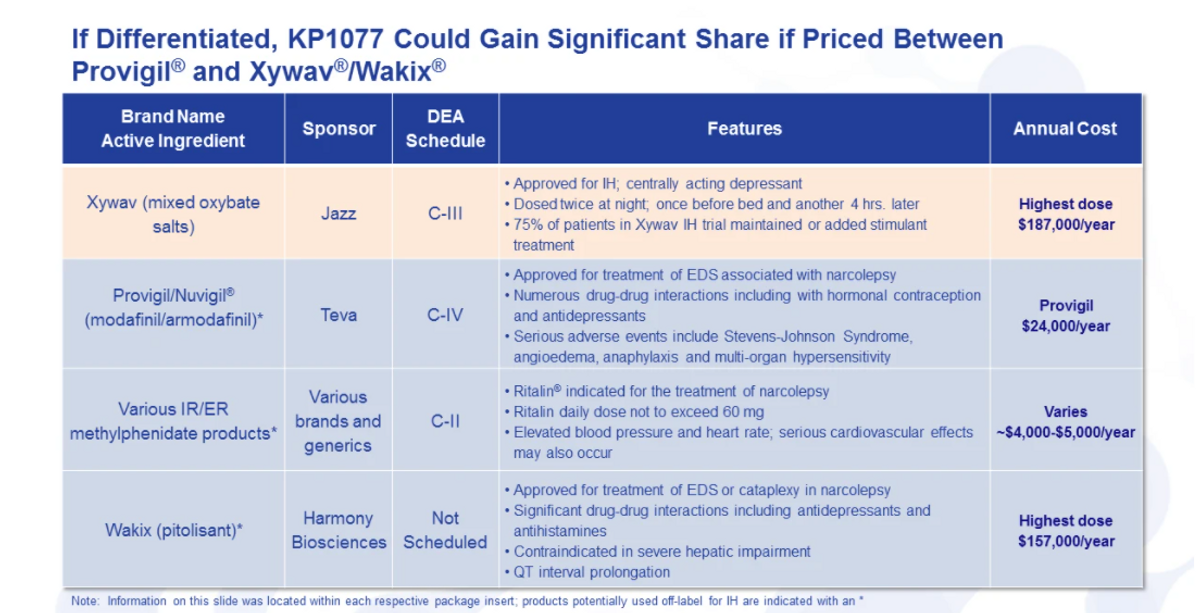

Turning now to a kind of the competitive landscape, where we kind of see ourselves, you know, there is an unmet need in IH, and that we have seen repeatedly. Jazz has recently its Xywav product approved. It's, this is also used in narcolepsy. Previously, they had a formulation known as Xyrem that they're replacing with a Xywav product.

And you know, looking at this product again, it's, certainly, a very expensive, you know, $187,000 a year. And then on top of that, 75 percent of the patients in their trial to get to the approval of Xywav for IH actually either had to add a stimulant or maintain their stimulant treatment.

So while it did help, it wasn't the cure or the fix of all your symptoms, sort of a treatment. You know, really monotherapy in this study was 25 percent. So based on that, I think you can you come up with your own assumptions, on how well a stimulant does address some of the symptoms with IH.

There are three product classes that are used predominantly off-label: Provigil, Nuvigil, Modafinil products. Again, those are mostly generic. You can see Provigil pricing amounted to about $24,000 a year. Lots of issues with these products: serious adverse events, a lot of drug-drug interactions, especially with hormonal contraception and antidepressants, which I just said is a comorbid condition.

You have generic extended release and immediate release methylphenidate products, which we have heard, you know, do help, but they do not, they're just really limited to how much they could use. A lot of the dosing is limited by the label, as well as just by the fact you get high blood pressure, heart rate and other adverse events with high doses of immediate release and extended-release products.

And then Harmony did announce that they are intending to develop Wakix, their product currently for narcolepsy. Now try to develop that for IH. Again, significant price point and a lot of drug-drug interactions, more of a between a stimulant-non-stimulant treatment - works well for some, doesn't work well for others from what I've heard.

So moving on. Well. Ok. We got a sense for the marketplace. We know our competitive landscape is a great opportunity.

Now what is it about KP1077 that we can differentiate here? So this product is 100 percent serdexmethylphenidate. Dosing is unique - it can either be taken before bedtime or before bedtime and upon waking, so two options, depending on the patient's needs.

Features and benefits that we've already demonstrated. So this is something we already know based on our clinical data for the approval of AZSTARYS. This is a C4, so Schedule Four by the DEA — less than any of the other methylphenidate products at C2. There are no drug-drug interactions as I mentioned before.

The benefits that we hope to measure in the study - a greater tolerability - is probably the biggest benefit that we could see. So greater efficacy functionally, where again, we can give doses now that address some of these more problematic sleep inertia, brain fog at doses well above what you can do with other stimulants. And this is due to the profile, which I'll outline in a second.

The nighttime dosing uniquely addresses the sleep inertia. It comes on really before waking, so that your peak level is about where you should be when you wake up eight hours later. The morning dosing can help really address brain fog, and that's, as I said, one of the more problematic symptoms of IH. And then, of course, the lessened effect on heart rate and blood pressure.

This is a head-to-head sort of difference with other methylphenidate products. And it's what leads to a greater tolerability and higher doses. Of course, as an orphan drug, this would be an orphan drug designation possible, fast track eligible, breakthrough designation eligible. And similar to AZSTARYS, we have solid IP through 2037. There'll be an additional IP that will be filed, and if that's granted, would extend that to beyond that time period.

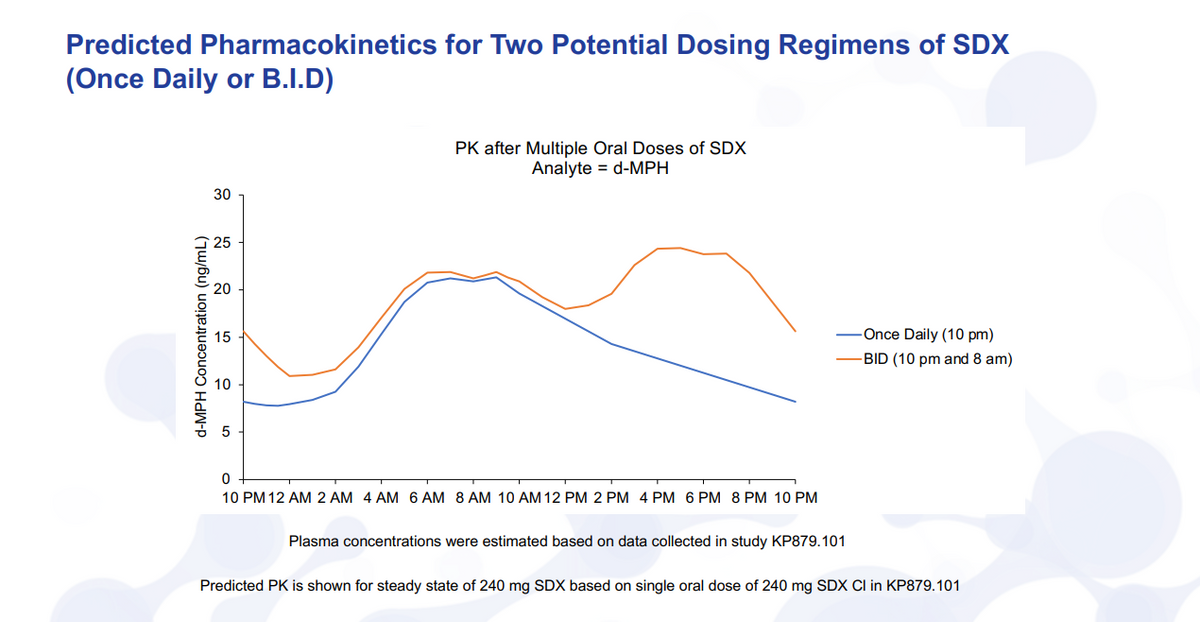

So just turning here to the data on the next slide. And this is based on the results of our KP879.101 study that we announced back in December. I just want to walk through this quickly here. But if you look at the blue curve, the once daily taken at 10 p.m., what you see is that you get this delay. So functionally, it's a flat curve and this is as you've taken it at 10 p.m. every day, say, for a few days. So it's steady state levels. What you get is a ramp that will start to ramp up in, you know, start to reach peak levels around six, eight, 10 a.m. and then slowly trail down the rest of the day.

Sleep inertia or waking is the primary issue. This may be sufficient for some IH patients, so having this dosing available, we think is advantageous. If you think about, though, for the vast majority of IH patients where they’ll have brain fog throughout the day and waking issues, then the morning dosing and the nighttime dosing will be the main feature, and that's highlighted there in the orange.

So take the first dose at 10 p.m., it's starting to ramp up, so you can wake up. And remember to take your eight-a.m. dose, where you're actually going to get a higher concentration, then in the afternoon and evening where, of course, you would want to see, you know, retention of brain fog, back to normal social activities and the ability to work throughout the day. We believe and have spoken to KOLs, this is a very advantageous profile for IH treatment.

I’ll just quickly review as we walk through, you know, what we believe we can do here for IH. So, you know, value proposition, these unmet needs that we are addressing, you know, this is more debilitating than narcolepsy. And it's mainly due to the waking and the brain fog. That doesn't occur in narcolepsy, doesn't occur with most, if not all other sleep disorders.

And as I said in the previous slide with the data, our PK profile allows us to give a higher dose and to be able to maintain that concentration of methylphenidate throughout the entire day, and then ramp them up early in the morning when taken in the night before. And that, we believe, is the fundamental basis for the differentiation of this product versus all others.

Certainly, there are no approved stimulant therapies for the treatment of IH, which we believe is very beneficial. Most of the products that are out there for treatment have some sort of other issue, and that's highlighted here on the next slide. The value proposition, looking at the comorbidities and patient demographics, it really does complicate the treatment. Brain fog is a big issue.

If you can address it with a product that doesn't raise the heart rate blood pressure, you can give higher levels without adverse events, then you can give higher doses to counteract that.

Half of the U.S. population has high blood pressure. And certainly, we know our pharmacokinetic profile will show a lower blood pressure and heart rate versus that of the current methylphenidate products that are used off-label.

Modafinil products, the Provigil, Nuvigil have drug-drug interactions with contraception. They also have some pretty serious adverse events that could occur. And then depression is a common comorbidity. Wakix and modafinil both interfere with antidepressant metabolism, and it has to be adjusted for that if you're on those particular medications.

With that all in mind, you know, we turned, did some payor research really looking at the landscape, what analysts were saying about IH and what this market potential could be. And what I have here is really an illustrative example. This is not an absolute market share. It's really intended to be ok, if everything looks beautiful and, you know, we can treat the vast majority of patients, we believe we could have a bigger opportunity than Xywav, for sure. And it's really unknown what Wakix could do.

You know, we were looking at several different examples here - look 37,000 patients as the entire population. Xywav is kind of the first. Analysts predict about 300 million in sales. And when you break that down after you figure out an average cost, that's about 3200 patients.

So going back to our original premise, we want small markets. We want to be able to commercialize. If you only have to reach 3200 patients, obviously that's going to be much easier than, say, a population like ADHD when roughly 10 percent of all Americans have ADHD. So I think that's a little bit of an illustration there why we are choosing these phases.

When you look at the mechanism of action and improved efficacy of KP1077, that will be the major determining factor for the differentiation versus Wakix, Xywav and some of the generics that are currently used off-label. Whether that's as a monotherapy or as a combination that we may consider using with sodium oxybate Xyrem, Xywav or some generic equivalent or prodrug version of that), you know, those combo products like Vertex and Gilead have done really to add a new layer of product strategy that, you know, this has the potential to show. An improved safety profile of the Schedule 4 drug-drug interactions. Xywav has some various uptake, high discontinuation rate - you still need to have a stimulant on board. It's seen as depression, abuse misuse potential.

The REMS program can be fairly complicated, though I believe if you have narcolepsy or IH, you can get through that. And of course, very negative stigma associated with GHB. Again, it's oxybate on the label, but in fact, it actually is GHB is the active ingredient here. They're both the same thing fundamentally.

Some things that are in our benefit. Xywav promotion has been very good, building a whole awareness campaign. Working with Hypersomnia Foundation, so they will build the market for us, it would be great opportunity. And then Wakix - we've outlined a little bit, has some barriers to uptake. The drug-drug interactions can be problematic. They have some AEs and potential other issues that we believe will limit that opportunity within IH.

So with that, we're turning now from KP1077 and our approach there with IH. Now we'd like to look a little bit and discuss our approach with business development and where we want to move now.

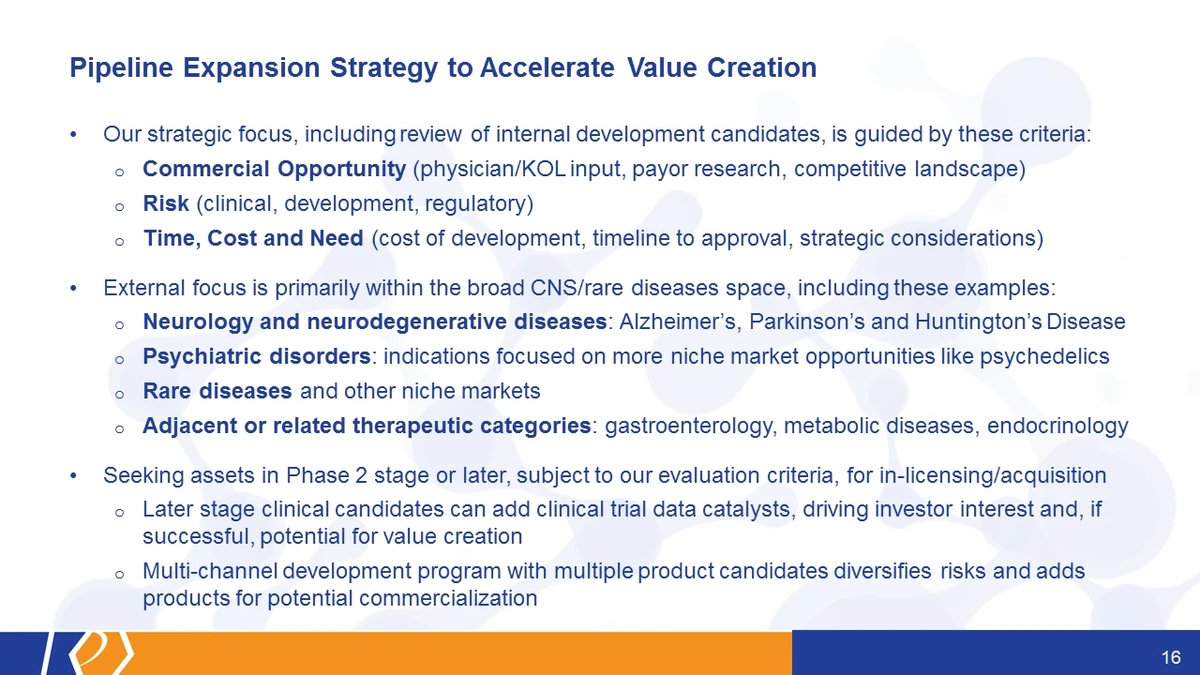

Our strategic focus has been and will be after the internal review of our own candidates, as well as any external candidates based on, you know, a number of different criteria: commercial opportunity risk, and time costs, and need. Now, with that commercial opportunity, you know, we look across the landscape: payors, physicians and competitive.

The risk, you know, there is a clinical development regulatory. I believe that's also assessing commercial risk as well.

And then, you know, time, and cost, and need. I mean, obviously, if it costs more and could be the same value, you would prioritize the cheaper version first if the value proposition was the same.

But there's other strategic considerations, right? Who else is in the space, where is the interest, where are investors? Where do investors want to see money flowing into? Where is there interest for drug development? And all of those are taken into consideration.

When we look externally to KemPharm and even when we look internally at things we could do, neurology and neurodegenerative diseases like Alzheimer's, and Parkinson's, Huntington's disease are obvious targets for this approach. There are some psychiatric disorders that would be more of a niche opportunity, and, certainly, market opportunities like psychedelics that where, again, investor interest is high.

Rare diseases that speaks for itself. And other niche markets. But then as well adjacent to related therapeutics, this really could be anything related- there's certainly some ability to kind of overlap, say, a GI - that's where we focused, actually, most of our delivery technology on. Metabolic diseases are heavily involved in our approach with prodrugs was metabolic processes, as well as endocrinology, and others.

And fundamentally, we're seeking Phase 2 assets or later as part of our evaluation criteria for in-licensing or acquisition. Later stage obviously is going to give you clinical milestones and catalysts sooner. And then once, you know, you're able to move that faster, you'll have again may be able to make up for time with a near-term commercial opportunity.

SDX itself actually presents, it's kind of a pipeline in a pill, you know, you have not only IH, but we, as we discussed before, narcolepsy. So after the IH trials are underway, you know, we will start to focus on narcolepsy. There's quite a bit of overlap there with clinical sites and development expertise, so we'll kind of utilize that across the board.

One thing I didn't touch on in detail was KP879. We believe again, this product is quite compelling. The opportunity is still there, and certainly the scientific data from what we received in our Phase 1 study was extremely compelling. Great data showed exactly what we wanted to see.

What we did after this analysis was, you know, really look through everything, and if you return briefly back to the slide before, you know, the commercial opportunity. I think there is a commercial opportunity there, but it's not as apparent - the competitive landscape in drug development is actually fairly large. There are quite a few candidates being developed for stimulant use disorder. Payers were a little skeptical when it came to what they would pay for it. So there was an ambiguity, you know, could be high could be low, depending on the attributes. I think that's obvious with most early-stage programs.

The risk was higher, you know, the program, as we already said, took a lot longer just to do the first study than we had hoped. We thought we'd have results faster, but ultimately, we met our timelines. But it was quite pushy there. Patients aren't that most reliable.

And of course, there's never been a product approved for it. So the development and regulatory risk, as we well know, being the first in class can be great from a commercial perspective if you get out the door. But most of the time you get punished for it, because the FDA doesn't know how to handle something that they haven't seen before. And I think really, it did also boil down to the fact that there's a high cost and this development will take a long time to work through, but we're not going to kill it.

This is a program that we believe, if we turn back, then to slide 17, that, working with government, academia and/or industry, that we could advance. There is an interest from various parties, third parties that we've met with in the past, they want to know about the program keep updated. We don't have enough data for us to move forward with, but at this point, it's obvious that we're going to need a partner to move this outside of KemPharm at any appreciable pace. So still in our pipeline, still moving it forward, we're just going to seek a partnership and get them to help us to do that.

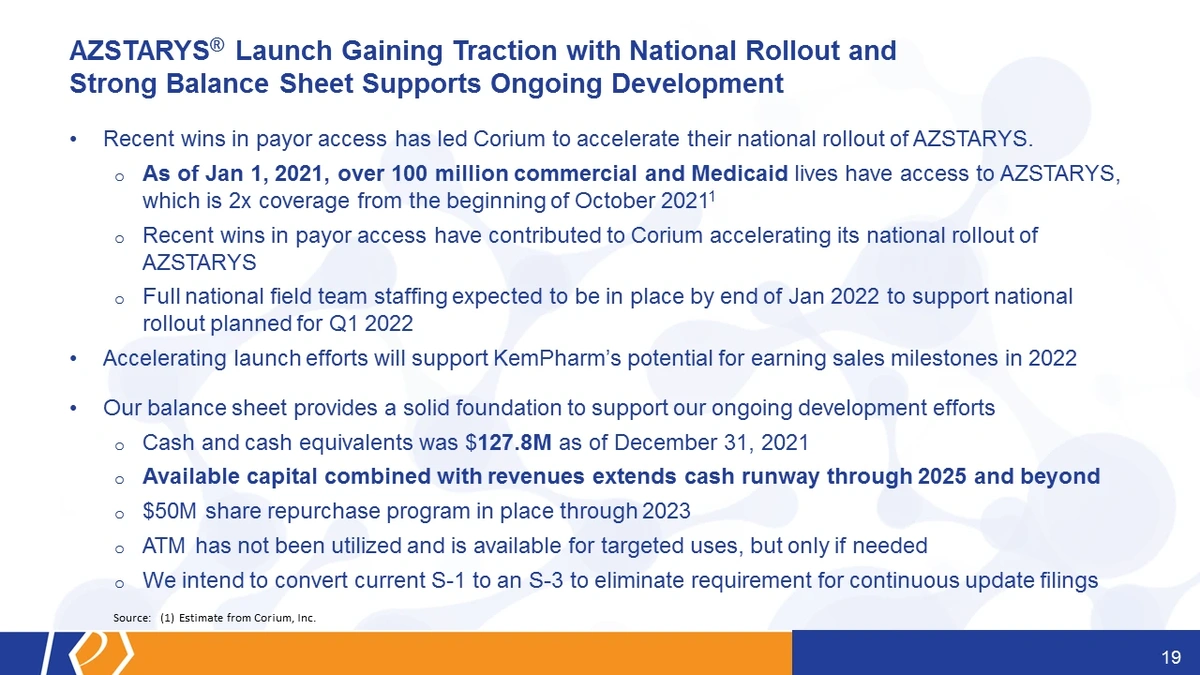

Turning now to the business, kind of side of this, the milestones and how we projected to move forward. I actually get to report here for the first time. I, probably, already saw it in the press release that the AZSTARYS's launch is actually gaining a lot of attraction.

As of January, 1, Corium has reported to us they have over 100 million commercial and Medicaid lives that have access to AZSTARYS. That's about twice the coverage from the beginning of October, when we last discussed this publicly. Recent wins really did allow them to say - "Hey, look, we're going to go from this kind of smaller launch to a full national launch". I expect that to be all in place by the end of January, so end of this month really to have a full national launch.

And then, you know, those accelerating launch efforts, the payer wins that we've seen, you know, do provide us support and clarity around what we think, you know, we could earn as far as sales milestones and royalties.

And so we've kind of taken that all together with our cash equivalents, really believe that the available capital combined with revenues, extends our cash runway through 2025 and beyond. With our current plan and current development programs, we believe that's a particular case, that may be well beyond even the point in which the company could be bringing in more from AZSTARYS at that particular juncture.

As many of you are aware, we implemented a $50 million share repurchase program back in the end of 2021 in December, which runs through 2023. The ATM has not been utilized. LaDuane will be happy for me to pass that along. It's a lot of questions.

We also intend to convert the current S-1 to S-3. This will eliminate a lot of the potential filings that you see. It's not a new offering. There is no new offering being contemplated. This is just to take the current S-1 that we have to update literally every single time we do anything, to prevent a lot of work costs, as well as to prevent a lot of confusion about what we are doing, and we're not raising more money every time we update the S-1.

Briefly, I want to touch on, just to remind you of some of the milestones and wrap up here. So clinical regulatory milestones for 2022. Looking for the final results of KP879 study, put that all in a proof-of-concept package and send that over to GPC Corium, KP1077 for IH - that's Type B meeting this quarter with the FDA and IND filing mid-year. Phase 1 cardiovascular differentiation trial will start in Q2, should wrap up by the end of Q3. Phase 2 initiation Q3. Narcolepsy will follow about six months behind IH.

And then kind of looking ahead, you know, really, there are several things that I'd love for you to take away from this, but really hope you can walk away with a sense for what we're hoping to accomplish both in the near term and the long term. Fundamentally, we're focused on what we've done well in the past, as well as trying to eliminate the pitfalls that we've seen not only with ourselves, but with some of the other comparable companies at various stages in their development.

This general approach was actually validated somewhat today with the acquisition of Zogenix, the announcement of the acquisition of Zogenix by UCB.

I can remember back when Zogenix had an opioid extended-release hydrocodone trying to get through an AD COM at the FDA struggled to get it approved and then struggled to sell it, and then eventually they sold that asset, and were able to use that capital to focus on a rare CNS disease, rare form of epilepsy. And ultimately, that's what they're acquired for today, I believe, it was for $1.9 billion with a CVR for some additional capital as well, if they do well.

So clearly, this is not a novel approach. I think it fits right within what our strengths are and has been implemented in the past. So now that is kind of where we hope to go in the future, we expect to see more and more catalysts around these events that we have seen already that I have outlined in this presentation.

With that, I'd like to stop this portion of the presentation, take any questions from analysts that we may have today.

Jonathan Ashcroft (Roth Capital):

Thank you. Travis, you know, given what you know about KP1077 right now and the correspondingly early data from Xywav and Wakix, you know, what can you say about the comparison of these early data sets, and thus about any potential KP1077 advantages or disadvantages? You know, the exact data you have in hand?

Travis Mickle, CEO:

Well, certainly we know that, you know, this is going to have a stimulant like effect, right? So Wakix has a weak stimulant effect, but it really helps wakefulness through a different mechanism, right? For the H3 (histamine-3) antagonism. And so that works well for some patients in narcolepsy, but it doesn't work for all of them. And so I believe that will probably be translated similarly to IH.

Now Xywav estimates are around nine percent. That's a CNS depressant. You take it the night before. It has a completely different mechanism of action. Stimulant use and utilization is necessary to actually treat these symptoms, and treat them well. So in-hand right now, you know, we have a product that's differentiated on a drug-drug interaction scale. It's a C4 stimulant versus the other products.

As well as — it's going to address the primary issues, which are sleep inertia, waking, and brain fog. We already know that stimulants like methylphenidate do very well with attention, and brain fog is fundamentally at its core, an attentive sort of disorder, where if you can provide that attentive boost through the dopamine/ norepinephrine pathway, you're going to help eliminate some of that brain fog.

Jonathan Ashcroft (Roth Capital):

You know, given what you know now as well, how much would price competition be [for] sort of what you're thinking? You know, it's a pretty large part of it, or is it not really yet something you're thinking about as a main competitive edge?

Travis Mickle, CEO:

Well, I think it's an important question. At an early stage in development, if you're not asking where do we kind of position ourselves, then, you know, I think you're just hoping that it'll come out in the end. You know, Xywav and Wakix are very expensive, right? They're at the top end of all these different products now. Provigil, Nuvigil — those are, you know, a little bit more expensive, but, certainly, not, you know, in the range that Xywav and Wakix.

So, we see ourselves somewhere in there, between those two, where you have this enough clinical differentiation. Now, because of the dissatisfaction with the current off-label treatments for the most part — methylphenidate, Provigil, Nuvigil being predominantly what those off-label treatments are — you know, we expect that most of these folks will have already stepped through or failed the current generics.

So, you know, where we said is "well, before you're going to get the expensive Xywav and Wakix, let's try KP1077".

Jonathan Ashcroft (Roth Capital):

Okay. Thank you very much, Travis.

Oren Livnat (H.C. Wainwright):

So there's a lot going on this call. So if I may, before we get into KP1077, you talked a bunch about, you know, exploring other candidates — you know, potentially in-licensing, maybe internal stuff we don't know about. And looking at Phase 2, you know, you also talked about sort of a de-risked approach to a lot of this strategic review you took.

So I'm just curious, you know, what kind of investment are you considering making in an external candidate? If it's already Phase 2, presumably, it's not going to come — there's no free lunches, right? If it's already got the proof of concept. So you just, you know, sort of a size of magnitude of what you're willing to take on in light of your balance sheet, you know, would be helpful. And then I have some KP1077 questions.

Travis Mickle, CEO:

Yes, I think that's a good question. I mean, we don't have a specific "size of our balance sheet" sort of approach. I think you have to weigh, as well, what you're going to spend in development. Surprisingly, there's a number of good assets that I think have been overlooked, and given our expertise in drug development and regulatory, you know, we can dive into those and know well. OK, your data didn't come out perfectly. Hey, look, the agency, you know, could want to see this and well, if we design this study differently, as an example, right?

But you know, for the most part, we don't have a predetermined set of parameters. This could be very early stage. It could also be Phase 1 with kind of knowing what the MLA is and maybe with a different indication. So there's not a specific set that has to be these. But you know, ultimately, if we do bring in something else, you know, we'll have to assess where we are with our balance sheet and what we need to do in the future, and better have some good value and upside for shareholders at that point.

Oren Livnat (H.C. Wainwright):

And I know you're not giving guidance for, say, today, but just, you know, I guess, I mentioned ... and then you mentioned the balance sheet. You know, you talked about this very long runway into, you know, 2025 and beyond, which is obviously puts you in a much better place than a lot of other smaller companies these days and in the market conditions. So congrats on that.

But I assume that runway, you know, reflects your internal projections of Corium Azstarys economics coming your way. So it doesn't necessarily give us a good sense of how much money you're planning on spending in the foreseeable future. Can you give us any sort of sense of what kind of investment this KP1077 program is on the R&D side, I guess between now and, you know, end of Phase 2? Or, maybe even looking further beyond how expensive those kinds of programs might be?

Travis Mickle, CEO:

LaDuane, you want to take that? I'm happy to do so [alternatively].

LaDuane Clifton, CFO:

I'll take a first crack and thanks, Oren.

In terms of the development spend required for KP1077 for the IH indication, we think that program is going to run pretty efficiently. I'm not going to give you an exact guidance today, but I think, certainly, we can fund it very easily with our cash balance as it is today.

And, Oren, since you followed us for a bit, you have a sense of how much it costs us to develop KP415 into Azstarys. And so we think that the development program is going to be similar, maybe slightly less than KP415, but that's a rough range.

LaDuane Clifton, CFO:

As we looked then to adding other indications like narcolepsy, Type 1 and Type 2, think of it as sort of not a whole new development program, but rather add-ons to expand the label. So one or two, or whatever is required additional studies or trials.

So if you take the base spend of, I don't know, the range of 40 to 50 million and then you add another 20 to 30 million, you can see how we can be very capital efficient just to give you sort of a general guideline that's modeled based on what we've done in the past.

Oren Livnat (H.C. Wainwright):

Ok. And then just to get on to the product profile potentially for KP1077, you know, it seems pretty intuitive, obviously this stimulant effect. But I guess just to help us better understand the differentiation. You know, you mentioned, you know, you showed these really cool curves with flexible dosing.

So the first thing that, you know, question that seems obvious to ask is how might a stimulant, I guess, impact nighttime sleep in that scenario where you're taking it at night? And is that going to interfere with quality of sleep through the night, or would a second dose make it harder to fall asleep at night, given those curves that you showed us?

And, you mentioned brain fog a couple of times, which, I don't think that was a regulatory endpoint in this space with Xywav being the one product approved. Should we assume you're going for a traditional EDS (Excessive Daytime Sleepiness) endpoint? And in Phase 2, is that something you're doing? Is that what you're going to be aiming for? And is that head-to-head versus placebo? And you know, I guess what kind of dosing are you looking at in Phase 2?

Travis Mickle, CEO:

Okay. Yeah, a lot of questions.

Oren Livnat (H.C. Wainwright):

I know. A lot in there. I apologize.

Travis Mickle, CEO:

I'll try to break it all up. I did take notes along the way. So as far as going with the curve. I mean, this was a primary question that we all had here at KemPharm. You know, these folks, if you have any level at night, is that going to cause any insomnia, and overwhelmingly, the physicians and KOLs said "no".

We have patients that take these things before bed and fall right to sleep. They have such a compelling desire to sleep that this is not going to be an issue. And of course, as you noticed in both cases, the lowest trough levels occur for the most part at night, right? Midnight to really 10:00 p.m. to roughly 4:00 a.m.. So for the most part of the night, you're going to have the lowest level of stimulant on board.

In terms of how brain fog goes. There is a validated endpoint for brain fog. Now that could be a key secondary endpoint. Our Phase 2 study will be more of a traditional dose, you know, figure out what dose strengths work, which one of these dosing regimens or both the best in patients.

Travis Mickle, CEO:

Our primary endpoint will, of course, be safety and tolerability, but what we're really looking at is the Epworth Sleepiness Scale as our endpoint, right? That's validated. Our indication would not be for EDS. We're looking at just a general IH, because IH covers more than just an excessive daytime sleepiness for these patients and includes other symptoms as well.

So if you can improve the ESS scale, we believe that will be really meaningful for patients. But looking more at brain fog as maybe a key secondary or another secondary — that could be either, you know, in the label on the first path or as, you know, add-on at a later point.

Oren Livnat (H.C. Wainwright):

And is that an open label or are we going to actually have placebo controlled efficacy in this Phase 2? Because you're saying it's primarily a safety and tolerability study, which I guess we normally think of as, you know, an earlier stage?

Travis Mickle, CEO:

Yes, it's kind of a hybrid, right? Between like a Phase 2a and a Phase 2b. It will be against placebo, but there will be an open label titration phase. So we'll have interim data and we may be able to announce before the topline data comes out just to show hey look, what we're seeing as far as trends, as far as doses, and what the differences were from baseline, but it wouldn't be from placebo. Eventually, the data will be represented as, you know, versus placebo.

Oren Livnat (H.C. Wainwright):

Ok, great. I'll hop back in after this one, if I'll have a chance. Thanks.

Travis Mickle, CEO:

I don't have many remarks today. I really appreciated everyone joining and attending today's call. Certainly, the continued interest in KemPharm really helps push us forward. I'd love to give more updates — I'd love to continue on the various discussions, and we will do so as we get new data and new information to pass along. I appreciate your time again. Thank you, everyone.