Thank you everyone for joining us again today. For those that are not familiar with KemPharm, I would like to give just a brief introductory statement. KemPharm is focused on the development and discovery of novel rare CNS and neurodegenerative disorders as well as lysosomal storage diseases.

While historically, we have a number of other assets that have been licensed, our new focus is on the development of potential products that we could internally commercialize. That is all built on the foundation of strong science as well as a good financial foundation.

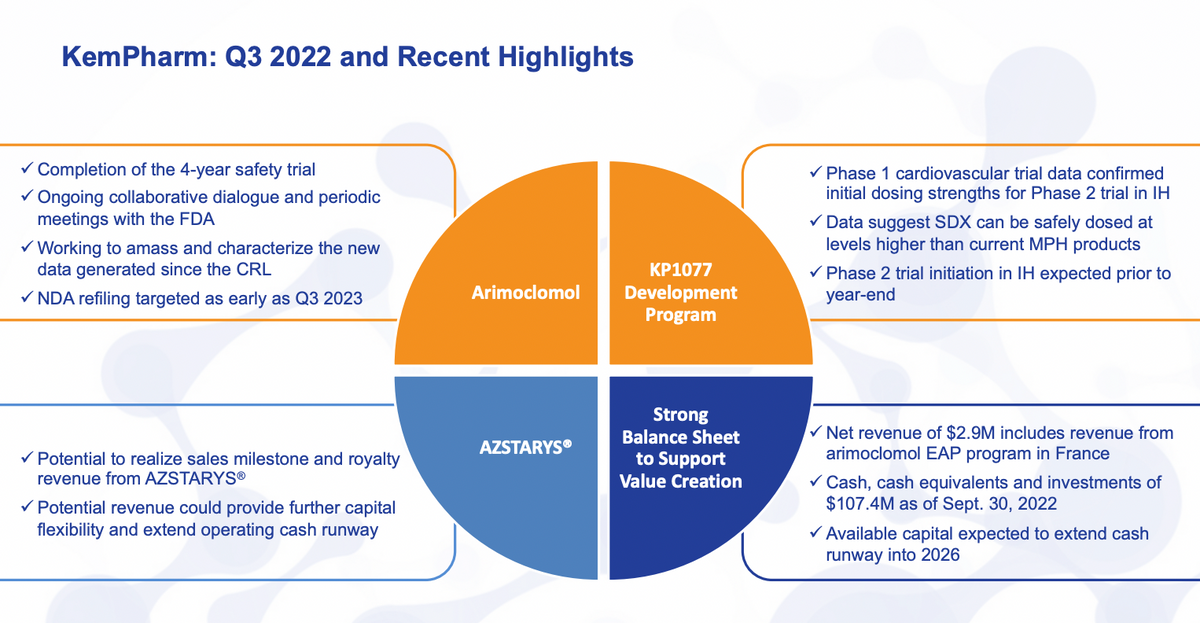

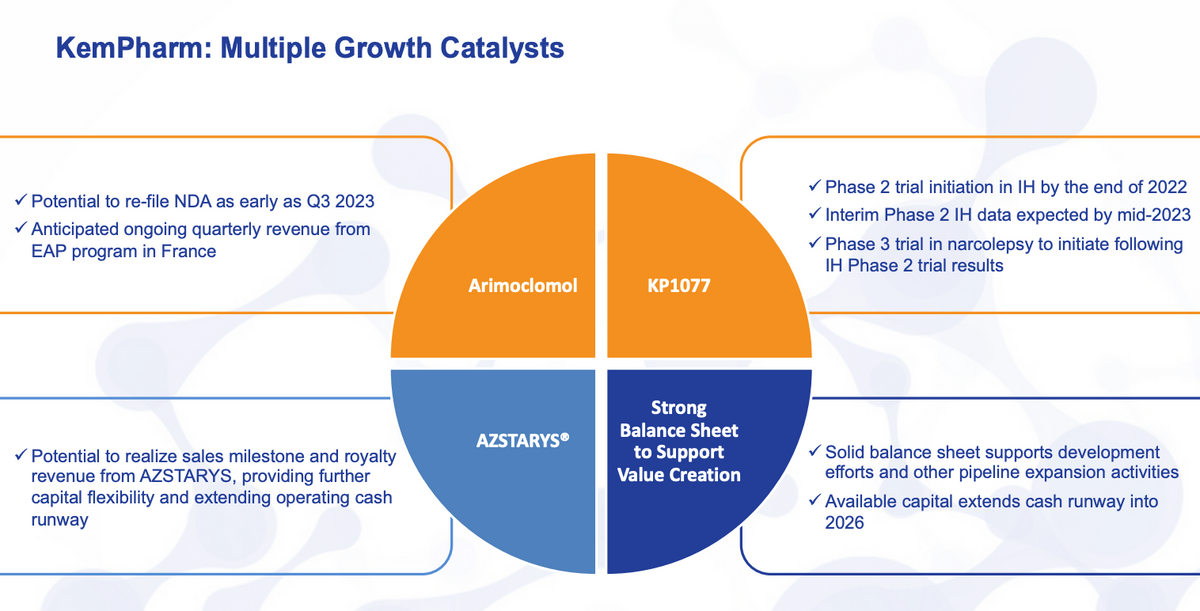

Just to go over briefly the recent highlights and from the press release, and results from the Q3. Of course, there are a number of different things going on with arimoclomol and many of these.

We have not continuously updated, but just as a highlight, we recently had the completion of the four year open label safety trial for arimoclomol, demonstrating a long term effect as well as safety of arimoclomol over that time period.

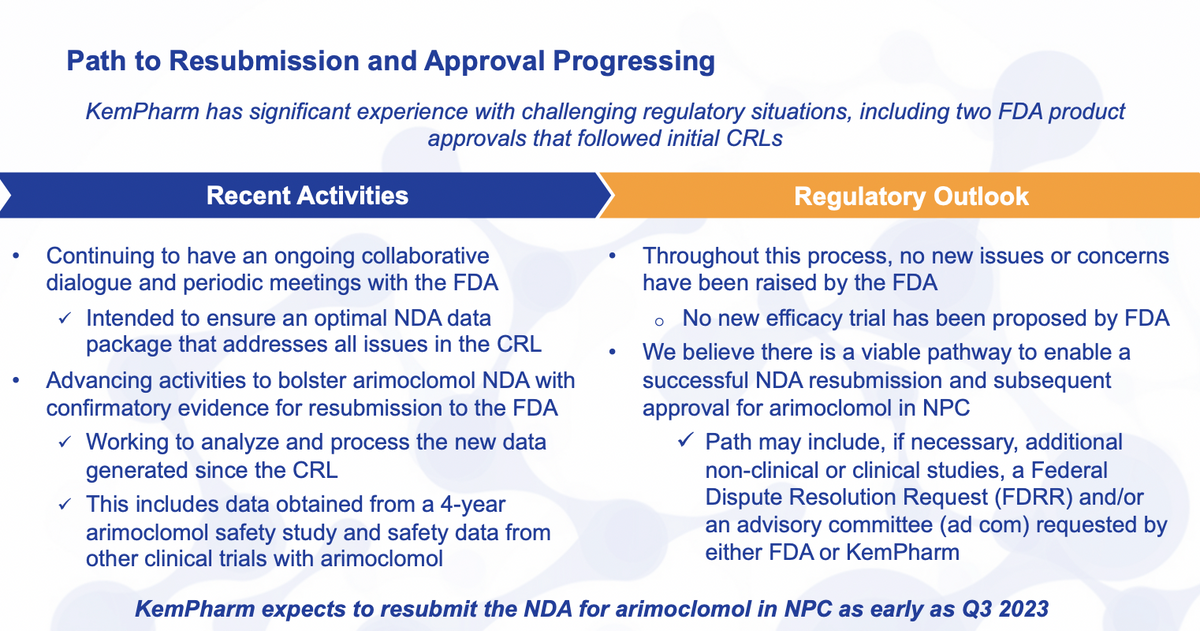

We have been having ongoing collaborative dialogue with the FDA. This includes meetings, submissions, back and forth with questions and answers and so forth. So a very collaborative discussion there.

And we have been working to bring in all the new data as well as some of the other data that we weren’t expecting to have to add to the NDA. Based on all of that, we are now targeting the resubmission as early as Q3 of next year.

AZSTARYS® continues to generate sales and milestones. We know that Corium is continuing their effort there. The KP1077 development program is going well. We have just announced results of the Phase I cardiovascular trial.

Certainly very positive results for us indicating we are right on track where we want to be with that particular program in development. And then with that, we do expect to initiate the Phase 2 trial before year end.

As LaDuane will highlight a little bit in more detail, we do have a strong balance sheet. We have had revenue from the French EAP as we expected, as well as other forms of revenue and have ample capital to do everything that we expect to do and perhaps a lot more.

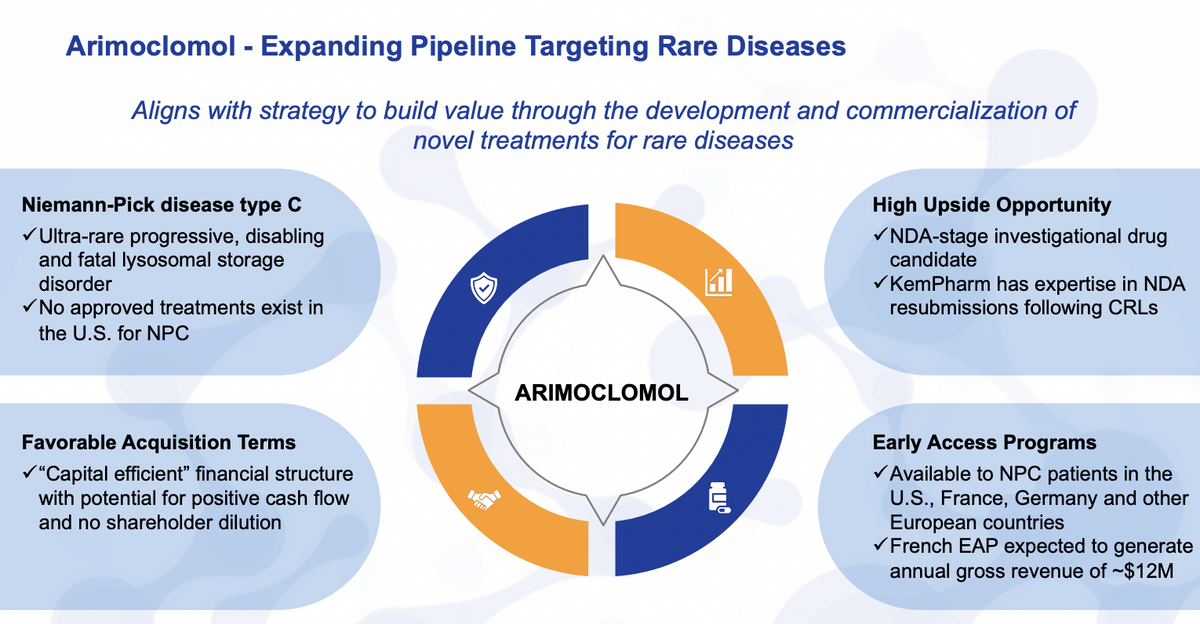

So specifically looking at the various product development highlights, just a brief overview of arimoclomol... Arimoclomol is intended for the treatment of Niemann-Pick type C. This is an ultra rare lysosomal storage disorder. Most of the side effects being related to neurological symptoms, related to cognition, hearing loss, speech, swallowing, etc.

We were able to acquire the product after a CRL and some financial difficulty from the former sponsor Orphazyme. We were able to get it in a highly efficient structure. We see this as a high value opportunity for us, not only something that already generates revenue through the French EAP, but to really considerably advance the company into the commercial stage of these rare disorders. So with that, the intended resubmission in the third quarter will help advance those goals.

Looking at the path to resubmission, as I mentioned briefly, we are continuing to have this dialogue with the FDA, again submission of some of these studies that were completed prior to our actually getting the asset.

But since the CRO has been a part of this entire process, I do believe this shows the interaction with the agency has been very collaborative and that they want to see an advancement here. We are also working to bolster the arguments that were made in the original NDA as well as specifically addressing each of the CRL issues.

With that something that we were not aware of was that the four year safety trial was wrapping up and then that database would be locked and in fact the final report would be issued. Knowing all of that, it wouldn’t make any sense for us to submit that data, that entire study, submit the NDA associated with that without that data in there. We think it is very strong data, very supportive of our potential safety and efficacy for the product. So it is certainly something that we feel is a critical piece.

Looking forward I think one question that everybody should have on their mind, we see this potential delay from our previous guidance is: What else has the FDA said? And the FDA has not raised any new issues or concerns.

It has been really about reviewing what they didn’t know from the previous filings. And it is what has been generated since then. And there has been no request for any new efficacy trial from the FDA, a very critical piece here. No new issues then what we have already identified, as well as no new efficacy trial.

We still believe that there is a very viable path, but there will always be the possibility in any regulatory submission like this that we may choose to do some additional work. We may choose to go through an appeal process as well as request either by the FDA or by KemPharm potential for an Adcom for this particular product.

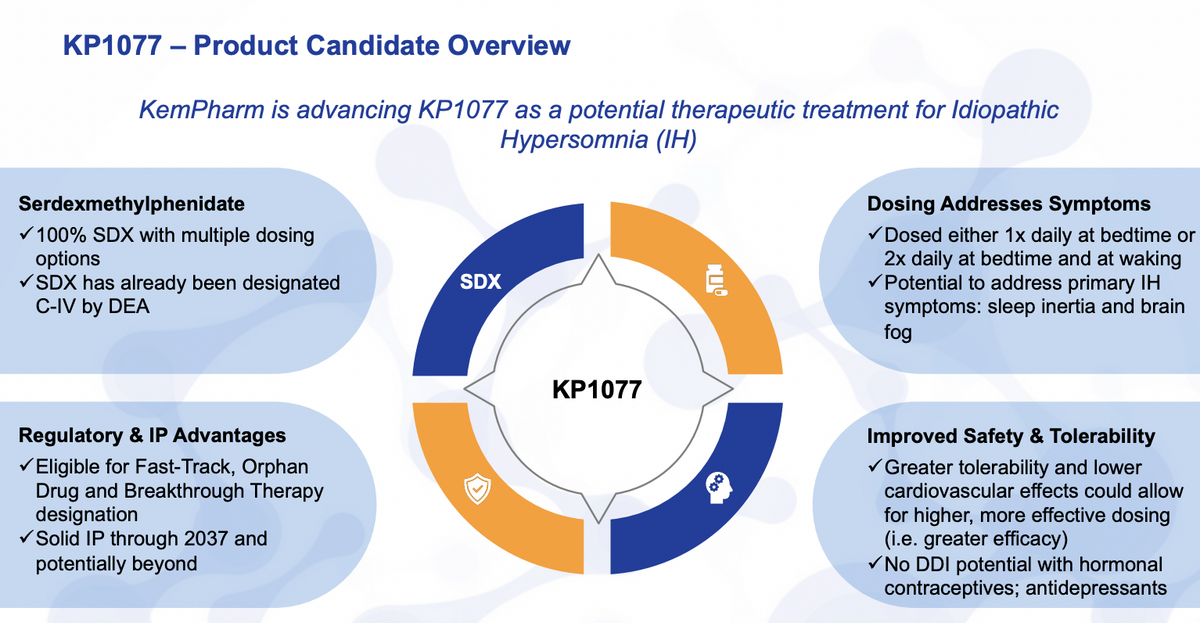

Briefly looking at KP1077, this product is actually intended for the treatment of idiopathic hypersomnia as well as narcolepsy. It is a 100% of serdexmethylphenidate, which is a prodrug of dexmethylphenidate that has already been designated as a C4 classification as far as controlled substance.

This is also an orphan disease, a rare disease, idiopathic hypersomnia actually occurs less than narcolepsy. Our intended benefit here is that we can provide higher exposure, providing more waking through a potential pathway that addresses the major symptoms of IH, including sleep inertia or waking as well as brain fog.

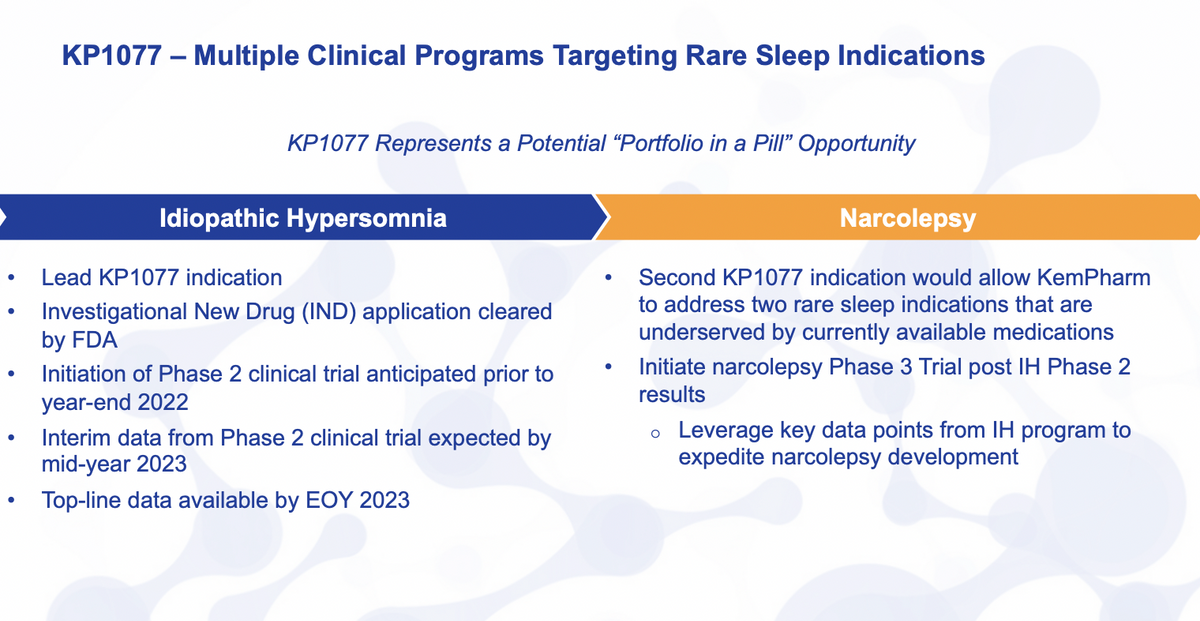

Looking at where we sit and what next stages are, for idiopathic hypersomnia, this is our lead indication. We filed an IND earlier this year. We expect to initiate our Phase II trial before the end of the year. Everything seems to be going well there.

Sites are enrolling, getting up to speed, starting to look forward to recruitment and so forth. We expect to have interim data from that Phase II trial by roughly midyear next year, we will provide more detail onto that as well as top-line data before year end of next year.

After we get that study underway and perhaps even after interim data, we will initiate a second study in this time in narcolepsy, that particular case, we are looking at the add-on designation and not as our primary commercial and development program.

So I think that gives an update on both of our development programs as well as where the status of the company is overall. I’m going to turn it over to LaDuane Clifton to provide some more details on the financial position.

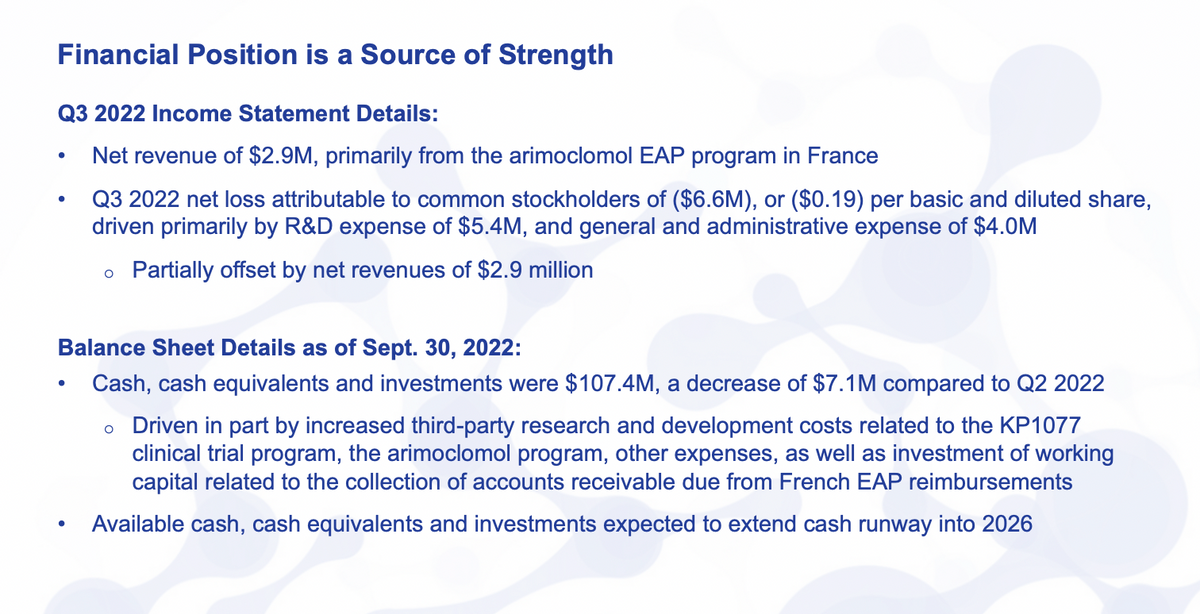

As Travis mentioned earlier in his opening remarks, we had another positive quarter, a good quarter and specifically our balance sheet remains very strong. Revenue reported for this quarter is 2.9 million which is net certain liability, associated with a remarkable EAP program that is coming in as we expected. Our net loss for the quarter is about $0.19 per basic and diluted share, which was driven primarily by R&D expense and G&A expense. But again, offset by the net revenues.

As of September 30, our cash balance was $107.4 million and that is a decrease of about $7 million compared to the prior quarter. It really consisted of the ongoing third-party R&D cost as well as other expenses and notably investment of working capital related to a French EAP program.

So you will see on our balance sheet that there was an increase in accounts receivable. And so as we move forward, we do expect that cash flow to begin operating in a normal course. Ultimately, our cash balance based on our current operating forecast allows our resources to extend our runway into 2026.

And also, as Travis has mentioned, to the extent that AZSTARYS generates royalty revenue or additional milestones which we still see as pretty much an important thing to be looking for, that will have the effect of potentially extending that runway further.

So just looking forward as we go and review the upcoming milestones kind of reiterates our intention to re-file the NDA, Q3 of next year, anticipate of course, the quarterly revenue from the French EAP program. For AZSTARYS, we will continue to monitor scripts and see how that goes.

I think that those are certainly tracking in the right direction for KP1077. Have the expectation for the trial to start by the end of the year. Interim results should be available mid-year with those particular final results by the year end, as well as the initiation of a narcolepsy trial sometime in 2023.

And then as LaDuane highlighted again, a solid balance sheet, a lot of good possible expansion opportunities, not just with our pipeline, but through what we already have in arimoclomol and KP1077 and certainly a long runway that can only be bolstered by additional revenue. So with that, I’m actually going to turn it over and see if there are any questions.

Sumant Kulkarni, Canaccord: It looks like at this time you don’t have any new requests from the FDA, but has the agency already finished reviewing the new data that you’ve generated? If not, when do you think the FDA could finish that? And how confident are you that the FDA’s new analysis will not lead to the need for a new clinical trial?

Travis Mickle: It's an ongoing sort of review. So we have submitted, and I won’t give particular details, but whatever we have submitted to the agency, they have fully reviewed. There will be a detailed review post-mission. I mean, that is just a standard course, but they have already asked questions and weighed in on some of the information.

That is not the totality of that information, where we could actually file the NDA if it were. We have more to provide them as well as more to put into the NDA that they won’t be able to review until then. So I hope that answers your question.

Sumant Kulkarni: And then it seems like the safety study is the new piece of information that is the key thing that led you to this potential - like the delay in the potential filing. So were there any specific findings in the safety study that you might consider new or counterintuitive relative to the safety data that is already publicly known on arimoclomol? And is there any risk related to continuation of an EAP program for the product based on the new safety data?

Travis Mickle: That particular study and the results, it actually did as well measure the NPCCSS. The efficacy score was continuously measured as well. Actually, it showed a long and lasting effect of arimoclomol in those patients who were in the study, which would have been not just four years, but five years in total.

And additionally, there were no safety signals that were different than there were in the double blinded phase of the trial. I think the data is great. It has already been presented by Mark Patterson at two NPC conferences.

So those results are already out there. Certainly, we can put those up on our website at some point here. I think they are helpful. I think there are also results of the two failed trials that Orphazyme attempted with ALS and IBM that show again the safety which is for 500 plus patients, there has been no significant safety signal from arimoclomol in all of that. And that it is pretty rare to have this type of disease with that level of safety and that many patients exposed for a long period of time.

Sumant Kulkarni: Could you give us any details on what specific parts of the proposed NDA package may be most in need of strengthening that led to this push out in the timeline and will you say that the new timeline is conservative relative to the information needed to be generated?

Travis Mickle: I would say, it is conservative. I think the difference between March and July is Q1 to Q3. So it doesn’t certainly have to indicate a six or nine-month delay from those sorts of things. But When we looked at what needed to be bolstered, there was nothing. I mean, we really had all the data. It is all about putting it together.

And then what has kind of led to this is the safety trial. It wasn’t something we anticipated putting into the submission. So that has to go in and we really do believe it is a cornerstone of our arguments for the benefit, as well as a sequential sort of submission pattern. The agency wants to see something and they want more from that.

So we can’t do things in parallel as much as we would like to. And so, it is that sequential pattern of providing more feedback, going back maybe meeting with them formally or informally that has kind of pushed it out a little bit, which again I think is entirely very positive, because we have never received anything back that has indicated otherwise.

Jonathan Aschoff, Roth Capital: Would you break down the revenue to an extent if you can, because it is not one 100% arimoclomol France. Can you help us out with just that?

LaDuane Clifton: There was a portion of that that was royalties that came into from net sales of AZSTARYS as a percentage of that. And you will see when we follow our 10-Q that was around we had around, we recognized about 200,000 or so of royalty revenue on AZSTARYS.

Jonathan Aschoff: Okay. So it is simply about 2.7 arimoclomol, 200 AZSTARYS and no other line item, right?

LaDuane Clifton: Yes.

Travis Mickle: Thank you again for your participation and joining us today. I appreciate the good questions, initial analysis and hopefully additional color on what we are doing and what we hope to achieve, not just our remainder of this year, but next year as well. So thanks everyone. Hope you have a nice evening.

KemPharm is a biotechnology company focused on the discovery, development and commercialization of novel treatments for rare CNS and neurodegenerative diseases, lysosomal storage disorders and related treatment areas. KemPharm has a diverse product portfolio, combining a clinical-stage development pipeline with NDA-stage and commercial assets. The pipeline includes arimoclomol, an orally-delivered, first-in-class investigational product candidate for Niemann-Pick disease type C (NPC), and KP1077, which the Company is developing as a treatment for idiopathic hypersomnia (IH), a rare neurological sleep disorder, and narcolepsy. In addition, the U.S. Food and Drug Administration (FDA) has approved AZSTARYS®, a once-daily treatment for ADHD in patients age six years and older containing KemPharm’s prodrug, serdexmethylphenidate (SDX), which is being commercialized by Corium, Inc. in the U.S. The FDA has also approved APADAZ®, an immediate-release combination product containing benzhydrocodone, KemPharm’s prodrug of hydrocodone, and acetaminophen, which is being commercialized by KVK-Tech, Inc. in the U.S. For more information on KemPharm and its pipeline of product candidates visit www.kempharm.com or connect with us on Twitter, LinkedIn, Facebook and YouTube.

This press release may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that do not relate solely to historical or current facts, including without limitation and which can be identified by the use of words such as “may,” “will,” “expect,” “project,” “estimate,” “anticipate,” “plan,” “believe,” “potential,” “should,” “continue,” “could,” “intend,” “target,” “predict,” or the negative versions of those words or other comparable words or expressions, although not all forward-looking statements contain these identifying words or expressions. Forward-looking statements are not guarantees of future actions or performance. These forward-looking statements include statements regarding the promise and potential impact of our preclinical or clinical trial data, including without limitation the timing and results of any clinical trials or readouts, the timing or results of any Investigational New Drug applications and NDA submissions, including the resubmission of the NDA for arimoclomol, communications with the FDA, the potential uses or benefits of arimoclomol, KP1077, SDX, or any other product candidates for any specific disease indication or at any dosage, the potential benefits of any of KemPharm’s product candidates, the sufficiency of cash to fund operations, the potential for and timing of milestone and/or royalty revenues, our plans or ability to seek funding, and our strategic and product development objectives. These forward-looking statements are based on information currently available to KemPharm and its current plans or expectations and are subject to a number of known and unknown uncertainties, risks and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These and other important factors are described in detail in the “Risk Factors” section of KemPharm’s Annual Report on Form 10-K for the year ended December 31, 2021, as updated by the Quarterly Report on Form 10-Q for the three months ended September 30, 2022, and KemPharm’s other filings with the Securities and Exchange Commission. While we may elect to update such forward-looking statements at some point in the future, except as required by law, we disclaim any obligation to do so, even if subsequent events cause our views to change. Although we believe the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this press release.