Operator:

Thank you for standing by and welcome to KemPharm’s fourth-quarter and year end 2021 results conference call. At this time, all participants are in a listen-only mode. After the speakers' presentation, there will be a question-and-answer session. To ask a question during the session, you will need to press star-one on your telephone. Please be advised that today's conference may be recorded. Should you require any further assistance, please, press star-zero. I would now like to hand the call over to Jason Rando of Tiberend Strategic Advisors.

Jason Rando:

Good afternoon, and thank you for joining our call today to discuss KemPharm's fourth-quarter and full year 2021 financial and corporate results.

Before we begin, I would like to remind our listeners that remarks made during this call may contain forward-looking statements that involve risks and uncertainties and are subject to change at any time, including, but not limited to, statements about KemPharm's expectations regarding future operating results.

Forward-looking statements are made pursuant to the Safe Harbor provisions of the federal securities laws and represent management's current expectations. Actual results may differ materially. KemPharm disclaims any obligation to update or revise its forward-looking statements, except as required by law. More complete information regarding forward looking statements, risks and uncertainties can be found in KemPharm's filings with the SEC, which are available on KemPharm's website under the Investor Relations section.

Speaking on today's call will be Travis Mickle, KemPharm's President and CEO, and LaDuane Clifton, CFO. Following remarks, there will be a question-and-answer session, which will include responses to questions that were submitted during the past week. With that, it's my pleasure to introduce Travis.

Thanks, Jason. And thanks to everyone for joining us today. So, a little bit of an introduction into KemPharm for those who are new to us. I'd like to speak a little bit about our value proposition.

KemPharm is an innovative company developing novel treatments in CNS and rare diseases. Historically, we've accomplished this with the use of prodrugs, like our approved and partnered products, AZSTARYS® and APADAZ®. Now, our focus is turned more to a broad base of drugs, including those in areas with significant unmet needs and high value with the potential to internally commercialize those at some point, if we decide to do so.

While we have two approved products, we remain, at this time, a drug development company and unique in today's market — one with revenue and no need to raise additional capital.

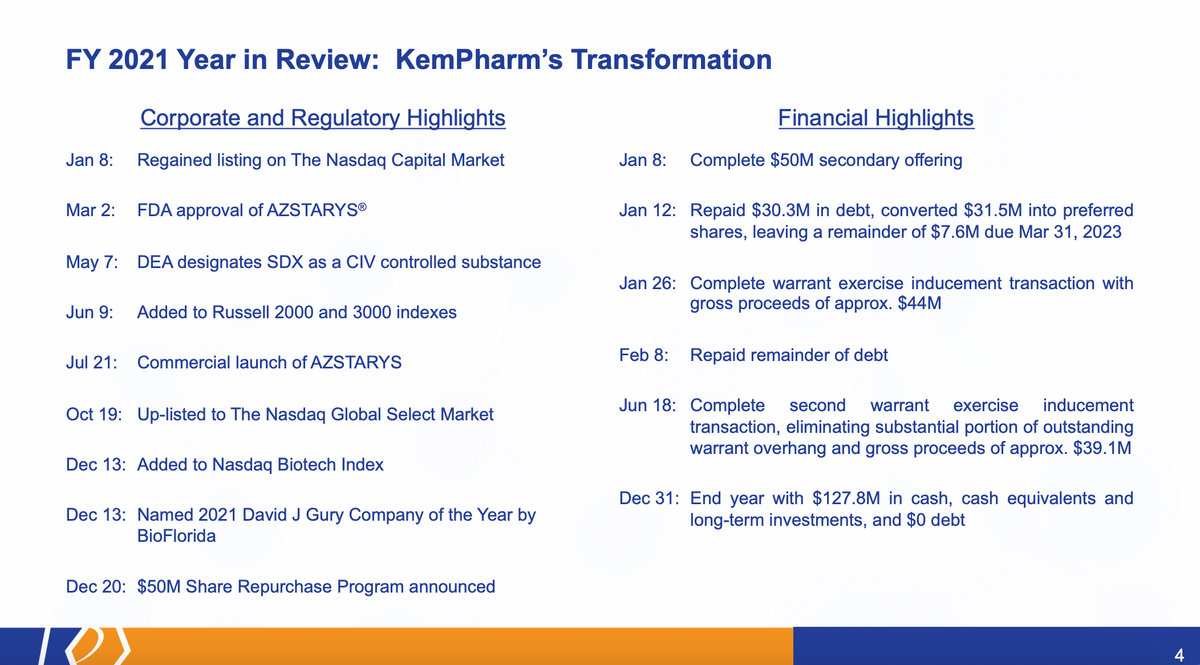

Turning now to kind of a year in review of 2021, as many of you may be aware, there was a Shareholder Letter that was sent out in 2021, outlining what needed to be done to significantly change the situation of the company at that time. And if you were a shareholder at that time, I think you were very aware that that situation wasn't very good. Based on that plan, we were able to execute a remarkable transformation of KemPharm in 2020 and 2021, highlighted by regaining our NASDAQ listing, eliminating all debt and the approval and launch of AZSTARYS.

That being said, we continue to build towards the goal of building substantial value with long-term shareholders and fundamental value in the company. Value still required some cleaning up, including reducing any more overhang, critical tools in place to monetize and create value, as well as to capitalize the company, so the future dilution will be unnecessary. In today's current marketplace, this is an invaluable resource to have. If other development companies are seeking funds, we have no need to do so.

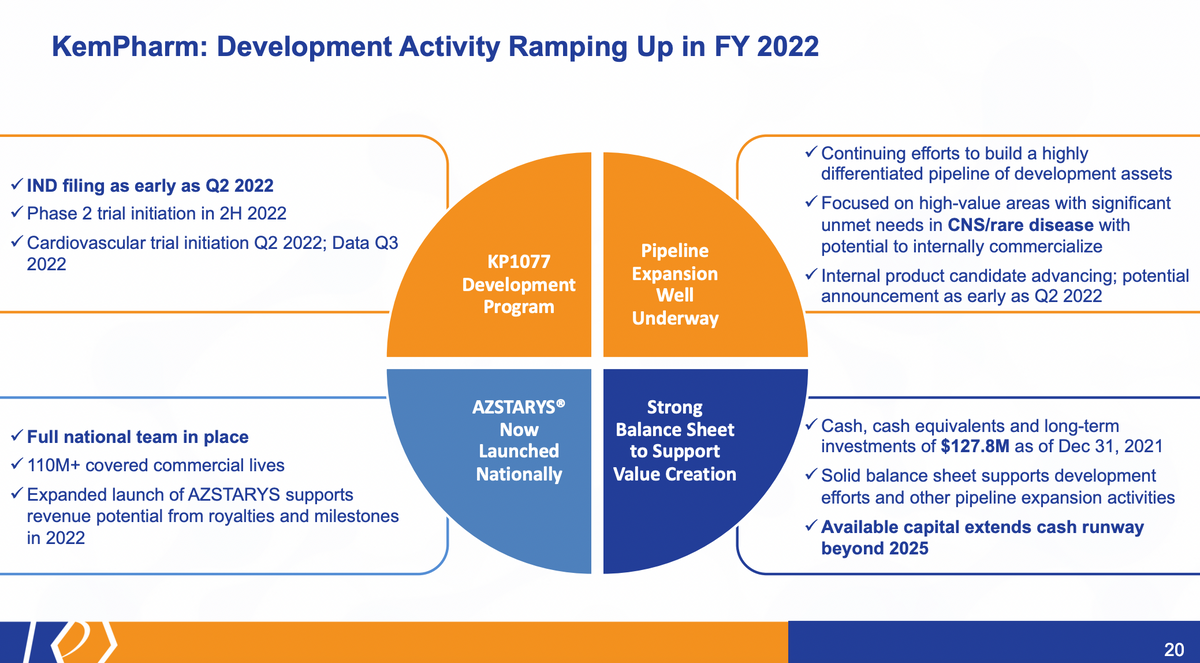

In January, we outlined our plan for 2022 and beyond, and we're already well underway to executing on its plan. We initiated the development program for KP1077, where we believe there's a high unmet need, high value proposition with a product we've already developed as part of AZSTARYS. We also continue to expand the opportunities in front of us with our pipeline through both identification of BD resources, so external resources that we could bring into our pipeline, as well as internal programs and products.

The AZSTARYS launch is actually gaining traction. We've seen this through updates from Corium — I'll provide more details later. The full national team is in place, and currently they have over 110 million commercial lives covered.

And this is all built on that foundation I've just discussed, which is a foundation with a strong balance sheet able to support everything we intend to do in the near-term and long-term for the organization. Cash and cash equivalents, long-term investments of $127.8 million as of at the end of the year, as well as the ability to support our continued efforts with capital [that] extends well beyond 2025.

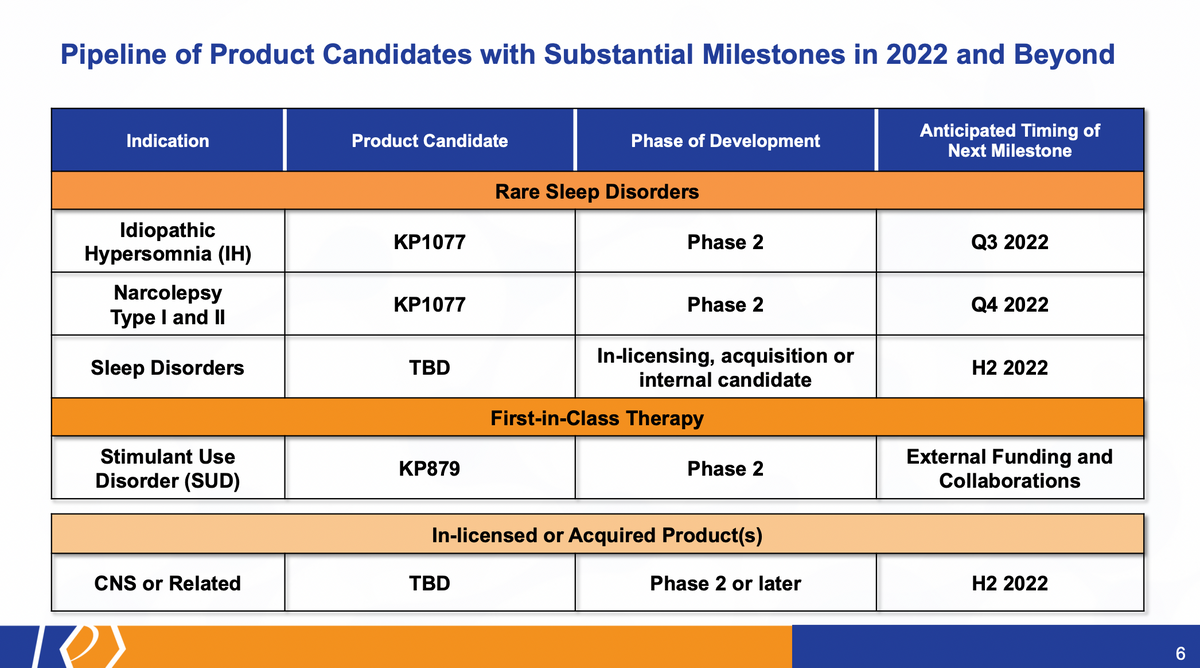

Turning now to our pipeline, these are just several of the highlights that we have here. KP1077 for its potential treatment in Idiopathic Hypersomnia (IH) is our most advanced candidate. It's now, it will be Phase 2, Phase 2 ready. We anticipate the start of that trial, and I'll give more details about various milestones close to the end of the presentation. But that study should start in the Q3 of this year, followed closely by the initiation of studies in narcolepsy, where products like this have shown some promise, as well as potentially adding to our sleep disorder pipeline through either internal or external, or both acquisition and internal candidate identification.

And then, as many of you are also aware, we also explore Stimulant Use Disorder (SUD). Again, this is an SDX-related product, similar to KP1077. The study and the results of that study really lead us to believe that we need to get external funding and collaborations in order to advance that program. And on top of that, we're trying to add to our current pipeline with some more advanced candidates. And ideally, this is focused around building additional clinical milestones and additional potential commercial assets, as we build out our portfolio of CNS/rare disease products.

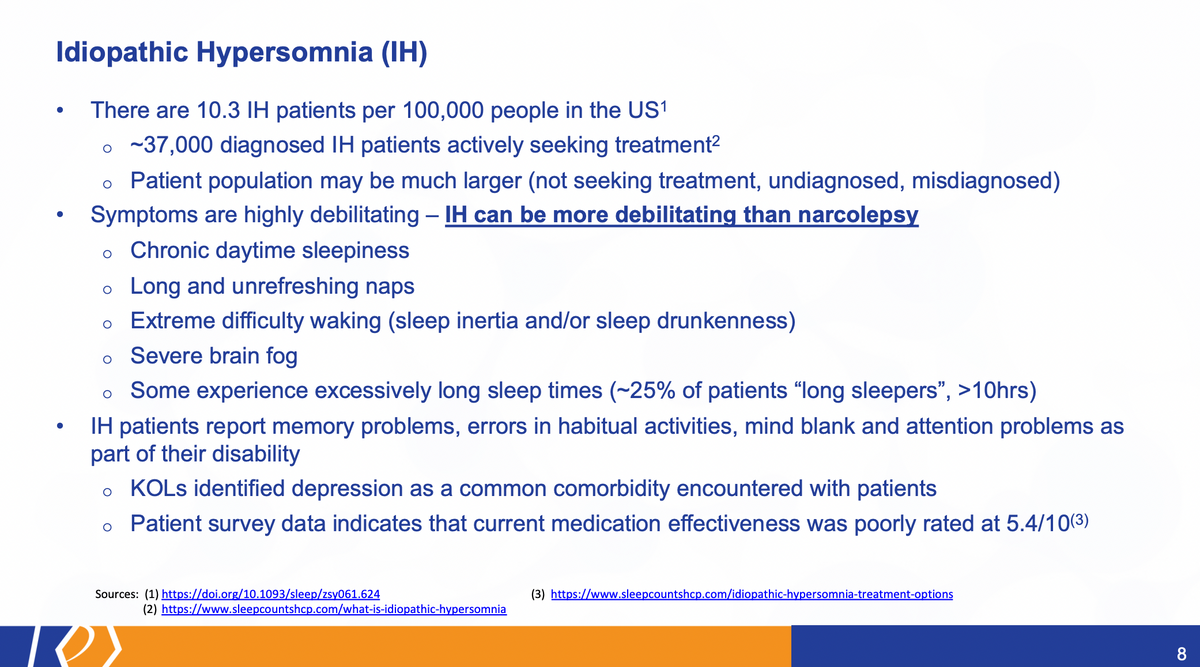

So let's focus a little bit more on SDX specifically, and the SDX product candidate opportunity. When we look at KP1077, as the potential treatment for Idiopathic Hypersomnia (IH), idiopathic hypersomnia fits the bill very well for a CNS rare disease. Less than roughly about 37,000 patients identified are currently seeking treatment in the United States. That number gets larger when you expand globally, but there is clearly an identifiable market within the US. The symptoms here for IH are very debilitating, and have been identified by many KOLs clinicians, physicians and patients as more so than narcolepsy.

The chronic daytime sleepiness is debilitating to the point of inability to drive, inability to work, inability to maintain social relationships. Long and refreshing naps, extreme difficulty upon waking, also known as sleep inertia, and then coupled with severe brain fog —and this is something that we're aware of, could be something very useful to treat and overcome, because many of the other products do not do that. IH patients have reported a number of different issues, but they also report that their current medication's effectiveness was fairly poor. So an available approved treatment option, as well as off- label treatment options just don't work, don't address the symptoms.

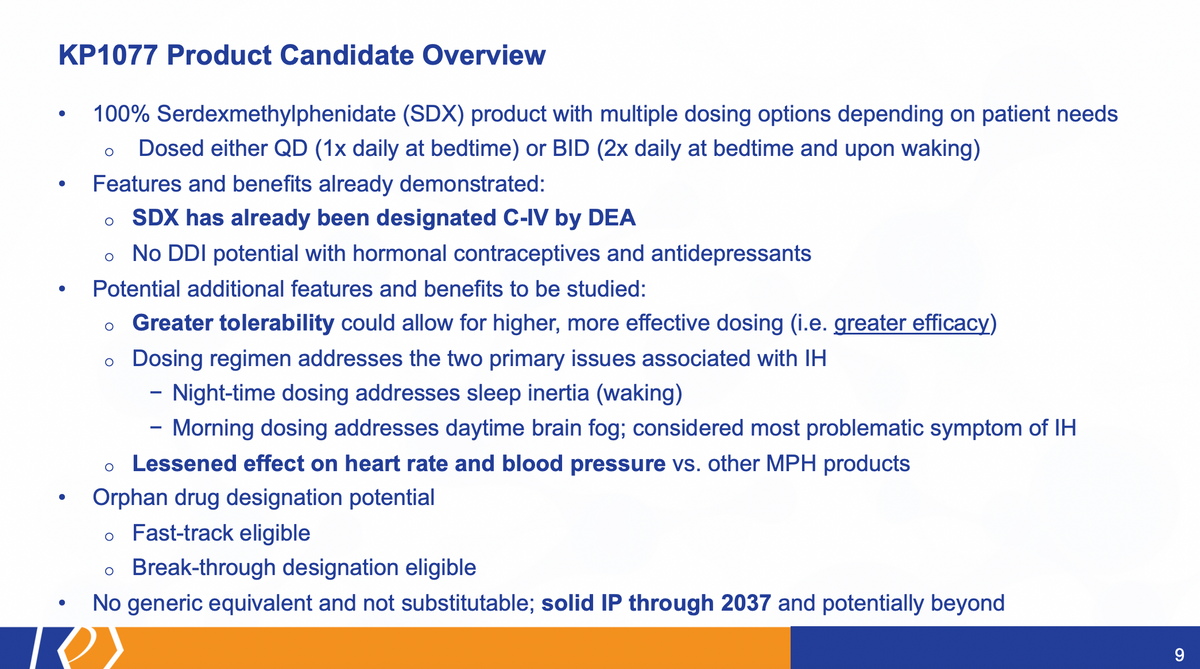

Turning now how we believe KP1077 could actually overcome this, this product candidate is entirely made up of our SDX (serdexmethylphenidate) product with multiple dosing options depending on patient needs. It is dosed either one time before bed or one time before bed and then upon waking. And this addresses the two issues that I spoke about before, which is the sleep inertia, the waking, the inability to do so. If you take it the night before, it should help to produce an effect early in the morning and aid in that waking process. If it's taken in the morning, that will help with the brain fog throughout the day. And when they're both taken together, you address those two major issues as one.

SDX has already been designated as a C-IV by the DEA. This is something we've already seen — its benefit inherent to the molecule. And, as it releases methylphenidate, there's no drug-drug interaction potential. It has the same interaction potential as all methylphenidate products and has no potential with hormonal contraceptives. And a common comorbidity with IH is depression, and it has no DDI potential with antidepressants.

What we're also going to be studying here, is the greater tolerability. Can we increase this dose, because the drug is more tolerable than other treatment options, including other methylphenidate based products. And when you get to efficacy then at higher doses, will this be something that patients do better on? The dosing regimen is unique and does provide an option that doesn't exist. And we are studying and will outline the timing of that. A lessened effect on heart rate and blood pressure versus other methylphenidate products. The product has, certainly, an orphan drug designation potential: fast track, break-through, and other options available to it. Solid IP through 2037.

We've recently announced the full results of the trial that we conducted with SDX. Initially focused on the treatment of stimulant use disorder, but fundamentally these subjects were used to a high dose of stimulants through their history of drug abuse.

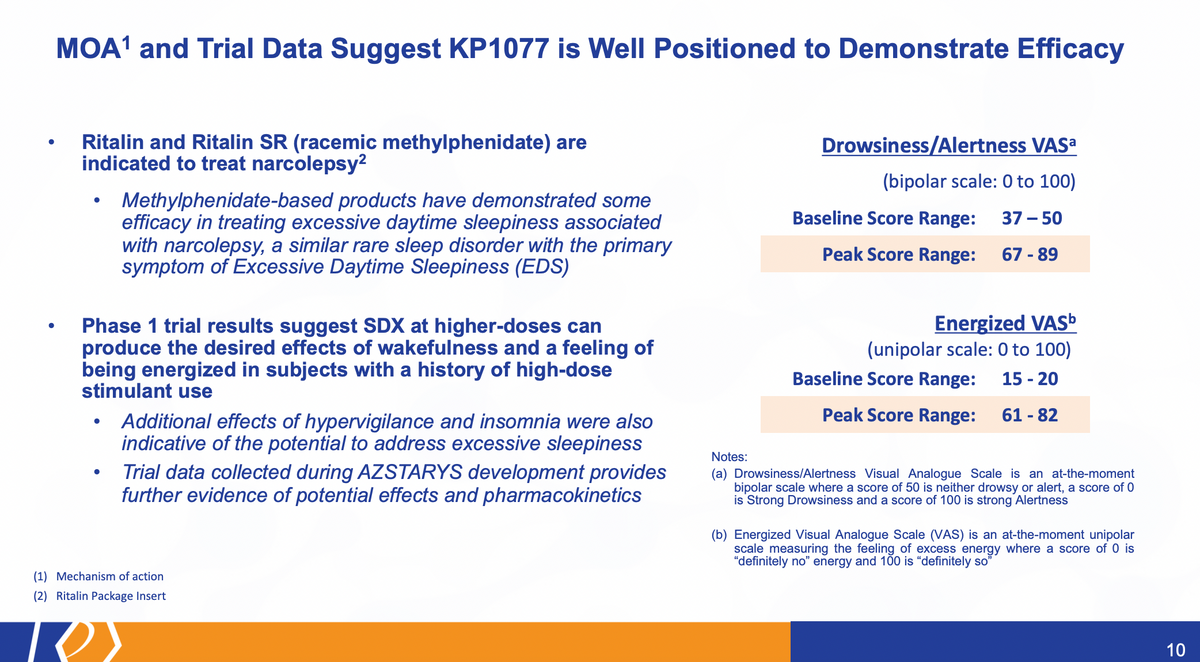

When we look at the trial data in its full entirety, as well as look at the history here of the use of methylphenidate, Ritalin and Methylin SR are currently already indicated for the use in narcolepsy. Narcolepsy is a rare sleep disorder with a primary symptom associated with Excessive Daytime Sleepiness (EDS). So again, Ritalin and Methylin SR are used to treat that part of the symptoms of narcolepsy.

So we believe, based on that, as well as the results of our studies, we're well positioned in our upcoming efficacy trial. We also saw in our Phase 1 trial, additional effects of hyper vigilance, insomnia were higher, which may sound bad, but actually is good in this case. Wakefulness and feeling energized, as you can see on the right hand side here, and these relative scales were much higher than the baseline score range that we had. So if you look at drowsiness, alertness — at this particular score, 50 is a baseline. I'm neither drowsy nor alert. I'm just here. You can see at the baseline, which is taken in the morning, people were slightly drowsy, right, they just woke up. And certainly throughout the day, when they get the peak score range, you know, it gets up to close to 90 on the scale. So, certainly, they are alert, based on this data, and energized. It's a unipolar scale from zero to 100, where the baseline range was below 20 while the peak scores were well above that. Certainly, a very positive indication that we're on the right track, when we talk about the efficacy of KP1077 for the use in IH.

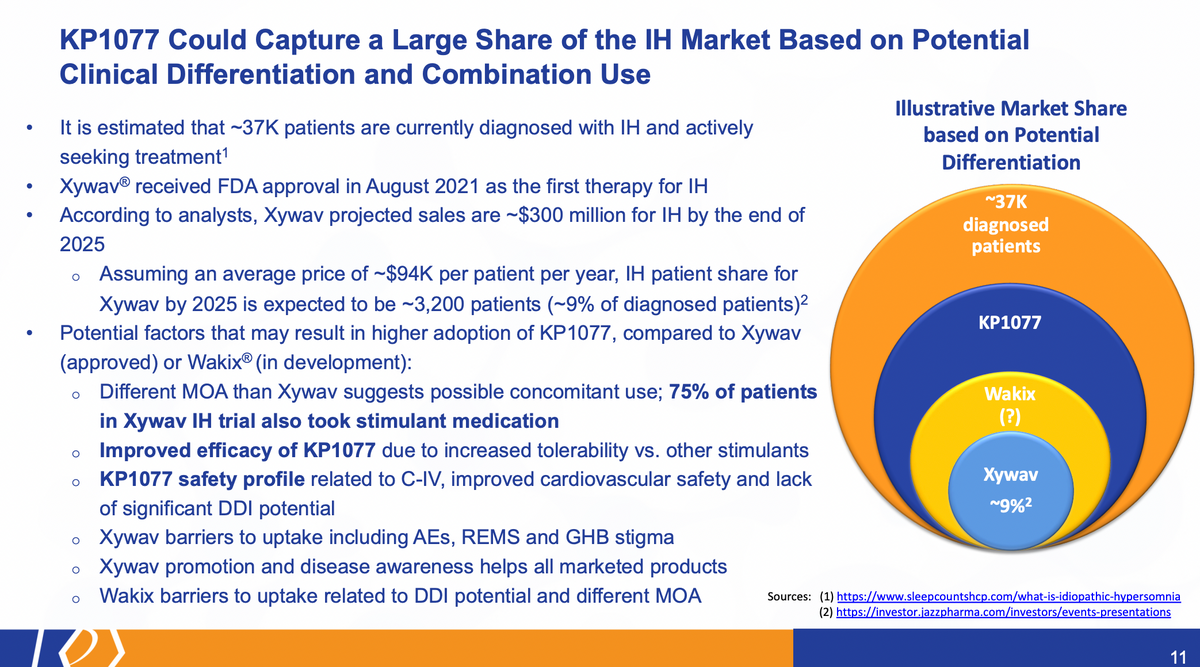

Now, I do want to spend a little bit of time here also reiterating the market opportunity, more to speak about rare diseases. It's fairly unique, right? We don't, wouldn't need, don't need a large salesforce. You basically know who the physicians are that diagnose and write treatments for these patients. You literally, in some cases, can know every patient, if it's an ultra rare disease.

Xywav is and was the first treatment approved for the idiopathic hypersomnia. Based on its various analyst reports, they estimate roughly 300 million sales could be associated with the IH indication for Xywav. And there's a lot of assumptions here based on, you know, roughly 9% of the diagnosed patients. So when we thought about this, again, this is an illustrative example only, we don't know what the actual clinical differentiation will be for KP1077. But assuming we get all the differentiation we want, we would assume that physicians would prefer us over other treatments. When we look at Xywav and the studies that they conducted — 75% of the patients in that trial also took stimulant medication. So this is not something that would exclude the use of a product like KP1077. In fact, in 75% of patients, it could include them as one of the options available there.

We believe that the improved efficacy, because of the increased tolerability, would also significantly position it in a good position, as well as the safety profile. To see, it's a controlled substance C-IV, an improved cardiovascular safety, and, again, the lack of significant drug-drug interaction.

The other things that would kind of help to lift KP1077. There are barriers for products like Xywav, including the AEs, the dosing regimen, the REMS program that's in place, and the stigma associated with giving GHB even as a therapeutic product. A benefit here is that Xywav is going to be promoting disease awareness, marketing the product. And that provides us an opportunity to piggyback on their efforts.

Wakix is another product under development for IH. And we believe there are uptake issues related to that, based on a different mechanism of action, not as well understood, as well as the potential for drug-drug interactions that I've mentioned previously.

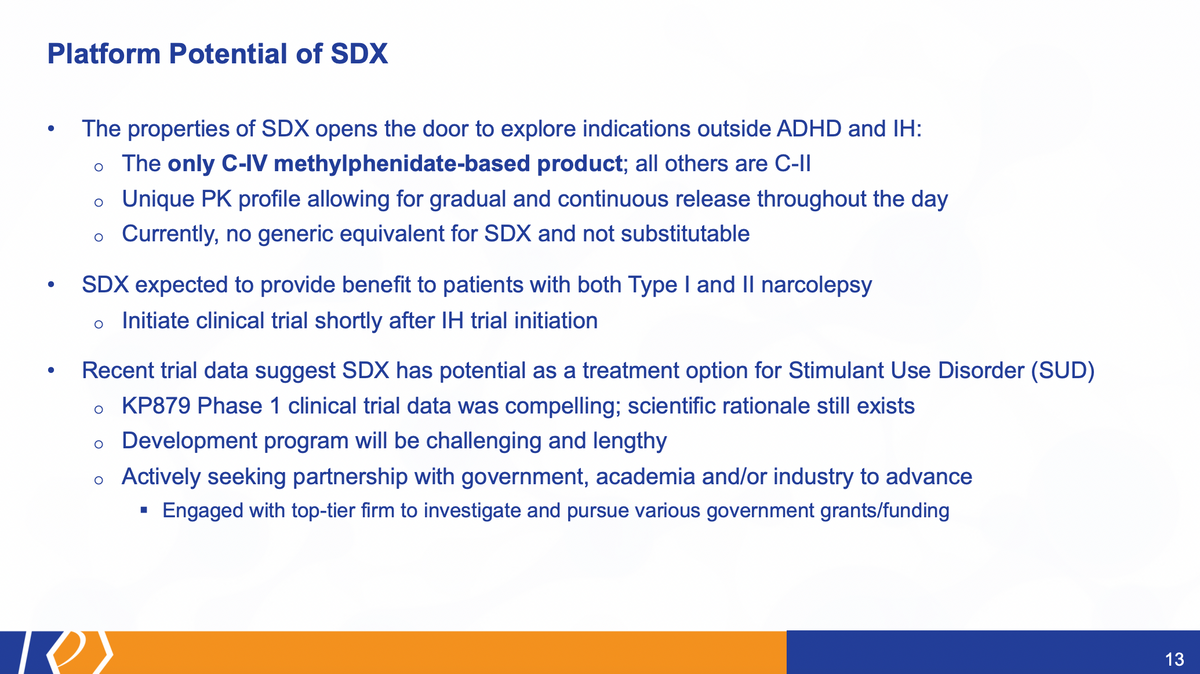

So looking at the other leg here of our four legged stool of how we intend to create value over the next few months and years. Looking, again, specifically at SDX, we're focused here on essentially a pipeline within a pill. We've looked at not just an IH and narcolepsy, but other disorders. And we continue to evaluate these as potential routes, in which we could commercialize a unique product that could address an issue within, you know, various other indications.

I've already mentioned Stimulant Use Disorder (SUD). That particular program has its own difficulties, it's a very challenging study that we conducted. We realized very early on that as we got results, that we needed additional partnerships there. We are actively engaged with top-tier firms to investigate government grants, government funding, government collaborations, as well as to continue to explore industry and academic collaborations to advance that program. It's something we believe has value. But we also believe it's better suited with experts in this field.

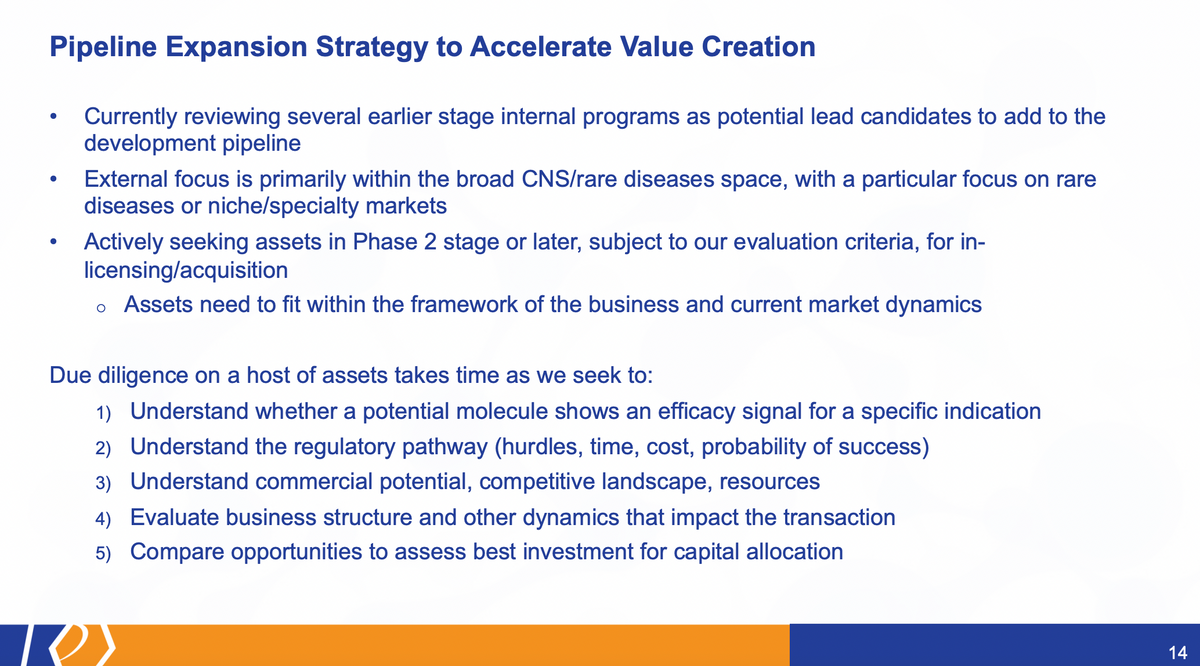

Looking at our pipeline's expansion strategy, I've mentioned already that we are advancing and looking to advance internal programs. I think we may have a lead within that space as early as next quarter, something that we could potentially announce. Now, in this particular space, in this particular instance, that would be fairly early in the development programs to something that's preclinical, we'd still have to go through an IND process, and several early clinical studies, which can be done very quickly, but at the same time, does not advance milestones as rapidly as we'd like here to create the value that we'd like to seek. So that's why we're adding in this external focus, we're actively seeking assets that are in Phase 2 or later, Phase 2 ready or later.

Of course, you know, these earlier stage programs have to be balanced with the later stage programs, where we believe the valuations are. I think we have a unique opportunity, the valuations are depressed at this point, just given the capital markets, you know, everybody is, including us, at this particular juncture. But this is an awesome time to actually look for things. We don't need the candidate, so we can be opportunistic, and look for the right ones.

Turning now to the update that Corium has passed along through us and what we're kind of being able to ascertain. We've got a lot of questions on AZSTARYS and Corium, and the partnership there. Corium has provided us with the following update. And based on what we have been told, they're very positive about the launch so far. They like where they are now. And they have not changed what they believe they can do in the future and where the opportunity really exists with AZSTARYS. So we're excited to hear that. And, you know, based on the data we've seen, and how we've been following them, we agree with that. It's exactly where it needs to be, they've done the right steps to get here, maybe a little slower than everybody wanted. That's just, you know, not the expectation that any of us have had.

The update that they recently provided here is that we have a full national team staffing in place. So as of a few days from now, they're going to have effectively doubled the size of their salesforce from 45 at the end of the year to 90 now. I do believe they expect to add some to that. But I don't have that definitively. There'll be, I think what's more important, you really see the results of some of that effort, which is the added 700 new prescribers in the first two months of this year. Sixty of those are, 60 of the previous ones as well have already written more than 30 prescriptions. And then, remarkably, and I can attest to this — over 2600 pharmacies have dispensed AZSTARYS. Luckily, I can actually easily get my script now. And I think that's a big part of this.

As of today, over 110 million commercial lives are covered. This does not include the entirety of Medicaid, which we'll believe will get an update at some point. In this 110 million commercial lives — so two of the three largest PBMs are already in place. And you can imagine, if the other largest one comes in, that number will go up significantly. So based on all of that, you know, this is still a good opportunity for KemPharm. This is our foundation, this is our revenue. But at the same time, you know, our focus has to be and will be on the development of other assets as they create more value for KemPharm and the organization. The current growth trend trajectory, based on what they've been able to do this year, does lead us to believe that there is the potential for earning sales milestones this year. So that's certainly within our expectations. And with that, I'm going to turn it over briefly to LaDuane to talk about the financial position.

Thank you, Travis. And good afternoon everyone. Travis has already made reference to all of the restructuring that we've done to our balance sheet throughout 2021. And that's really led us to a solid place of strength here as we look at full year results for 2021.

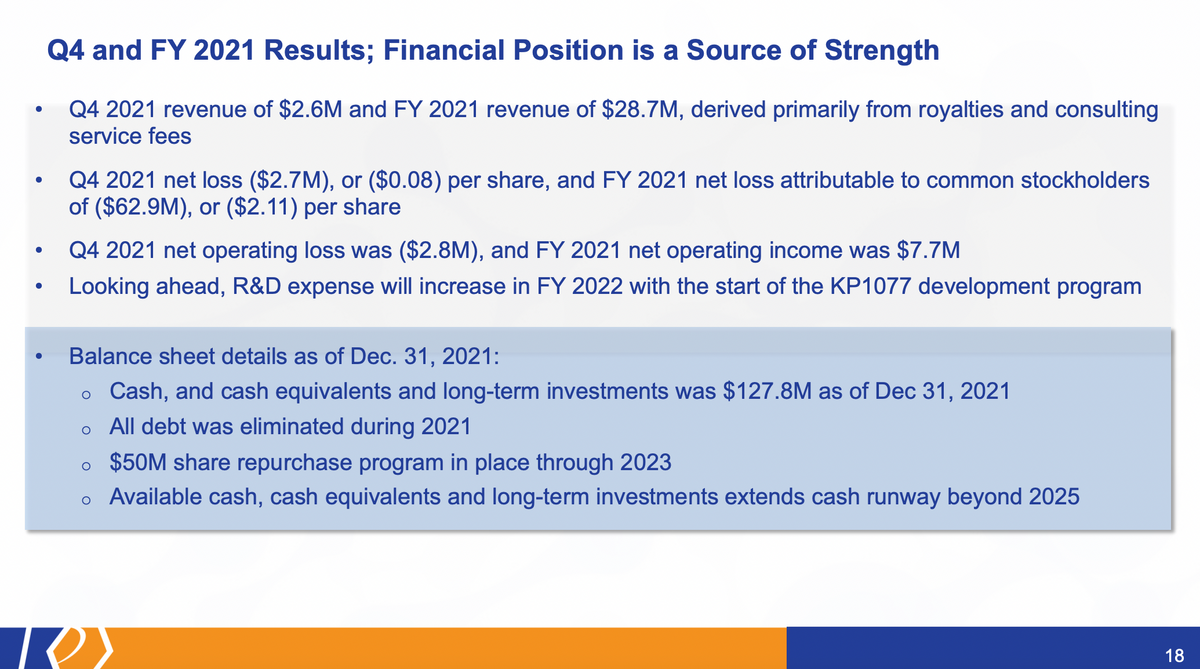

Q4 revenue was $2.6 million, and full year revenue was $28.7 million. And both of those were derived primarily from royalties and also consulting service fees. It's important to note that the consulting arrangement, the contract, we've been under ends this month, and so there might be a reduction of those, particularly with the recent approval of Adlarity. But we do think some consulting fees will continue going forward as we continue to support some work that's being done with AZSTARYS and etc.

Q4 net loss was $2.7 million, or $0.08 cent per share. And full year 2021 net loss attributable to common stockholders was $62.9 million, or $2.11 cent per share.

If you look at the next line, you see that the net operating loss was $2.8 million for the quarter. And then we actually had net operating income for the full year of $7.7 million. So there's quite a difference between those two, between net loss and net operating income. That's driven by a couple of non-cash items — about $54 million of deemed dividends, that's sort of non-cash item related to the warranty changes we did. And also a $16 million sort of paper loss, again, non-cash on the extinguishment of the debt.

As we look ahead, and given the timelines and the development energy that's going into KP1077, we do expect R&D expenses to increase during 2022. And going ahead as that program gets started.

With regard to our balance sheet details, as Travis has already mentioned, we ended the year with a strong cash balance of $127.8 million. And, certainly, all debt has been eliminated, and along with that all interest expense notably for the income statement. We did put in place the share repurchase program. And as you look through the details in our Form 10-K that will be filed later, you can see what activity has been there. And then, of course, as Travis has mentioned, all that puts us in a strong position is our cash runway, even with a cash burn, that's going to increase with the development increasing, it still takes us well beyond 2025. And we can find everything we need to do without needing to raise capital again. So with that, Travis, I'll turn it back to you.

Travis Mickle, CEO:

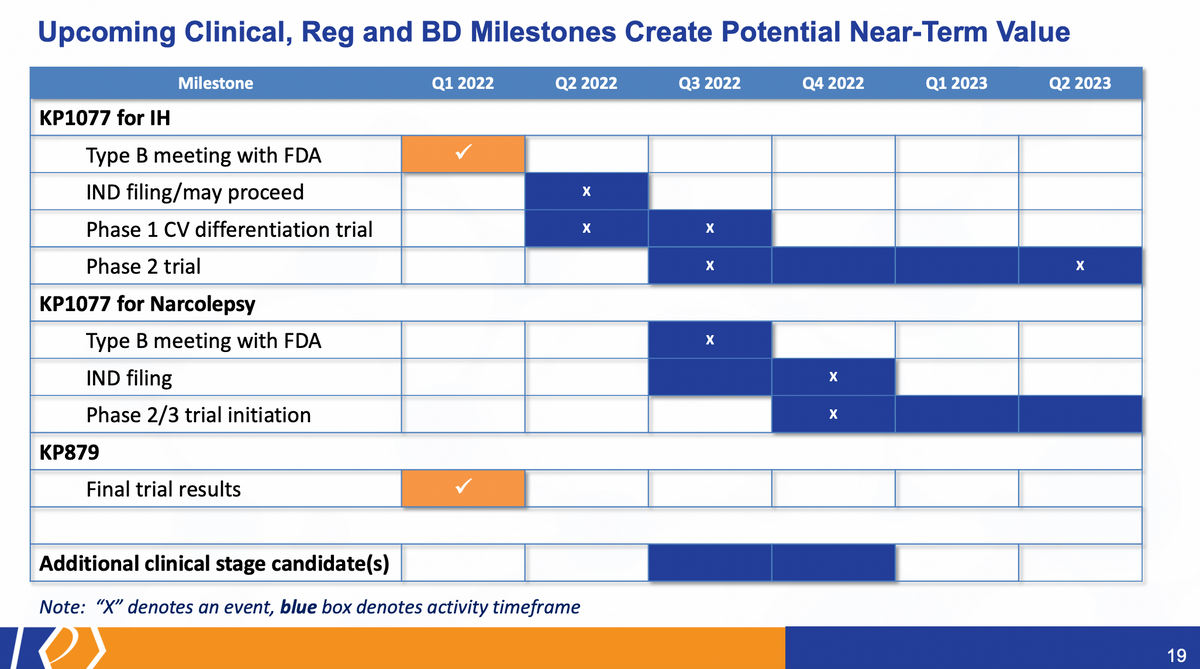

Thanks, LaDuane. Turning now and looking at some near-term milestones.

Suppose a few long-term ones were KP1077, looking specifically at IH. Again, we've just conducted our type B meeting with the agency, very receptive to the product, product idea, as well as the filing of the IND, which should happen in the second quarter of this year.

At the same time, we're roughly there. We'll be initiating a cardiovascular differentiation trial. There'll be more details about that to come. But that trial functionally will look like SDX versus the current methylphenidate products at high doses to distinguish the safety features related to heart rate and blood pressure.

We also expect in the second half of this year to initiate the Phase 2 trial for KP1077 with the results from that, top line results in the first half of next year. On its heels will be KP1077 for narcolepsy and related sleep disorders and related symptoms where we could have a type B meeting IND filing for that particular product this year and the initiation to follow with that. As I mentioned previously and not highlighted here, the potential is there to add an internal candidate as soon as next quarter to our pipeline of opportunities.

And to sum this all up, you know, our focus is and has been in the development programs. But I think there's a lot of value here that certainly exists within the company based on our various programs and various initiatives and efforts. Mission of the IND filing, the Phase 2 trial initiation and cardiovascular trial initiation — that data from the cardiovascular trial will be in the third quarter. So it's a fairly valuable endpoint, a data point that we're going to see in the third quarter of this year. Pipeline expansion, moving internal candidates forward, looking for external opportunities that are very synergistic with our strategy. AZSTARYS is fully going now, so, you know, watching what Corium will be doing, and relaying their efforts on, we have requested and do expect that over the next quarter or so, that Corium will host a joint call with us. So it provides you a little more color on the launch and how the product is going. We did this prior to an approval. And we hope to do that again, as soon as we can. We certainly don't want to distract them from making sure they do everything they can on the AZSTARYS launch, at the same time, providing an update as we can.

And then, as LaDuane mentioned, I mentioned, again, this is all based on the fact that we have an available capital. We don't need to raise capital. We're not going to be going out at this point. And I think that really creates a very strong company, a very strong opportunity built for the future.

Travis Mickle, CEO:

So with that, I think I'm set up and ready. We can take any questions if there are any.

Operator:

Thank you. As a reminder, to ask a question, you'll need to press star-one on your telephone. To withdraw your question, press the pound key. Please stand by while we compile the Q&A roster.

We have a question from the line of Jonathan Ashcroft with Roth Capital Partners. Your line is open.

Jonathan Ashcroft, Roth Capital Partners:

Thank you. Congrats on the progress, guys. And I have a question about. You know, it's great when valuations are low when you're shopping, but just how receptive are the people you're seeing out there? You know, from which you might want to acquire an asset? Just how receptive are they to sell down here?

Travis Mickle, CEO:

I think there's some receptivity, you know, the kinds of assets that we are focused on, you know, present unique opportunities, right? Because we have our technology that can add prodrugs, we can add runway to IP, so it's more than just a cash for an outlay approach. And I think the receptivity is something more strategic. And that's where our head has been as well.

LaDuane Clifton, CFO:

Along that line, I would just add, Travis, that also people find themselves since the capital markets are sort of dried up to the extent that they have a good product but can't raise capital. They also are more receptive from that side of it.

Jonathan Ashcroft, Roth Capital Partners:

Okay, thank you. And I was wondering if you could say anything about what Corium is, you know, coming up against in the market? You know, now I know, it's several months, and it's not that long into a market where there are several drugs. But can you give us any more color as to what might be the biggest thing they're pushing against?

Travis Mickle, CEO:

Well, I think they've overcome it, provided an update in the fall on this, you know, the biggest hurdle was the COVID and then the COVID lockdowns that happened again. And many doctors offices hadn't reopened, but they came up with other means to get into physician offices. And so, they believe they've overcome that. It's kind of the start of the new year. There's been no clinical pushback. The clinical profile, and the patients who have been on the product, love the product, there's refills happening. It's just, you know, it's about getting that momentum, and, of course, that payer access, so that you don't get any rejection.

Jonathan Ashcroft, Roth Capital Partners:

Okay, thanks. And lastly, a simple question. Do you expect OPEX to drop a little in the first quarter like it did last year, kind of maybe on to an end of year heaviness in, you know, non-cash stock compensation? Or is it going to be kind of up and away from, you know, the fourth quarter of 2021?

LaDuane Clifton, CFO:

No, I think in terms of operating expenses, the dip down that you're describing, it sort of happens historically. It likely will occur again, Jonathan. A lot of the spending related to KP1077 is probably going to begin to hit more in Q2 and beyond than really in Q1. So I think your expectation is reasonable.

Jonathan Ashcroft, Roth Capital Partners:

Well, thank you very much, guys. Take care.

Travis Mickle, CEO:

Thank you.

Operator:

Thank you. At this time, I'd like to turn the call back over to Travis Mickle for any closing remarks. Sir?

Travis Mickle, CEO:

As we look forward to the rest of 2022, it's a very exciting time - a number of different milestones are in front of us, a full national launch of AZSTARYS behind us. And we'll see how our partner there performs and are able to take that forward. Look forward to more interactions, more updates and more details as many of these milestones are met. I appreciate your time today. Thanks, everyone.

Operator:

This concludes today's conference call. Thank you for participating. You may now disconnect.